Get Pa Psrs-696 2012-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PA PSRS-696 online

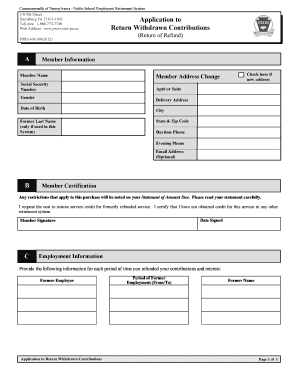

The PA PSRS-696 is an essential form for members of the Public School Employees' Retirement System (PSERS) looking to apply for a return of withdrawn contributions. This guide provides clear, step-by-step instructions to ensure that users can complete the form online with ease.

Follow the steps to accurately complete the PA PSRS-696 online

- Press the ‘Get Form’ button to access the PA PSRS-696 form and open it in your preferred editing tool.

- In the Member Information section, fill in your name, address, social security number, date of birth, and optional email address. If you have changed your address, check the box provided to indicate this.

- For Employment Information, list your former employer and provide the period of former employment (from and to). If your employment records include a different name, please provide it in the designated field.

- In the Member Certification section, ensure you read the certification statement and confirm that you have not obtained credit for the refunded service in any other retirement system. Then, sign and date the form.

- Once all sections are completed, review the form for accuracy, make any necessary corrections, and then save your changes. You can download, print, or share the completed form as required.

Complete the PA PSRS-696 online today to proceed with your application for returned contributions.

To change your address on your Commonwealth of Pennsylvania registration credential, you need to complete the appropriate forms available through the Department of State. You can do this online or by visiting a local office. Keeping your address current is important, especially as it relates to your entitlements like your PA PSRS-696 pension benefits, ensuring you receive essential updates and documents.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.