Get Or 150-602-005 2017-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the OR 150-602-005 online

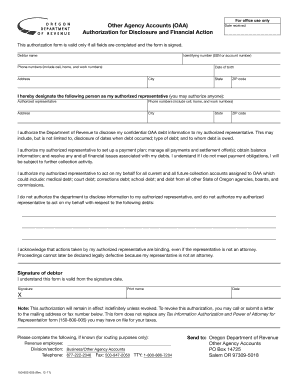

Filling out the OR 150-602-005 form is an important step for individuals seeking to authorize a representative to manage their debt disclosures and payment plans. This guide provides clear and comprehensive instructions for completing the form online, ensuring that users can navigate the process easily.

Follow the steps to accurately complete the OR 150-602-005 form

- Click ‘Get Form’ button to access the form and open it in your editor.

- Complete the 'Debtor name' field with your full name as it appears on legal documents.

- Enter your identifying number, either your Social Security Number or account number, in the provided field.

- Fill in your phone numbers, including your cell, home, and work numbers, to ensure easy communication.

- Provide your date of birth in the specified format.

- Input your complete address, including street name and number, city, state, and ZIP code.

- Designate the person you authorize as your representative by filling in their name.

- Include the phone numbers for your authorized representative, just like your own information.

- Fill in the address of your authorized representative, including city, state, and ZIP code.

- Review the authorization section and confirm that you agree to allow your representative to manage your confidential OAA debt information.

- Sign the form to validate your authorization. Ensure your signature is current and reflects the date signed.

- Print your name and provide the date of signature.

- Finalize your completion of the form by saving your changes, downloading a copy for your records, printing it, or sharing it as needed.

Complete your OR 150-602-005 form online today for efficient managing of your debt disclosures.

To obtain a veteran health identification card, start by applying through the VA to verify your eligibility. Gather any necessary documents, such as proof of service and identification. After your application is processed, you will receive the OR 150-602-005 form, which is crucial in your application process. Use our USLegalForms platform to ensure you have all the correct information and forms needed to successfully apply.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.