Loading

Get Nyc Rpie Faq 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NYC RPIE FAQ online

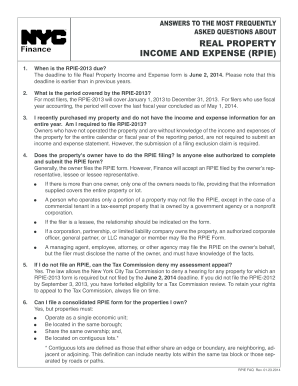

This guide provides you with clear instructions on how to fill out the NYC Real Property Income and Expense (RPIE) FAQ form online. By following the steps outlined below, you will ensure that your submission is correct and submitted on time.

Follow the steps to successfully complete your RPIE FAQ form.

- Click ‘Get Form’ button to obtain the form and open it in the designated editor.

- Provide your property details, including the property address and ownership information. Make sure all entered information is accurate.

- Fill out the income and expense sections, ensuring you input financial details for the correct reporting period, typically from January 1 to December 31 of the previous year.

- If you have multiple property owners, ensure that only one designated owner files the RPIE, but the form must cover the entire property.

- Indicate whether you are submitting the form as the property owner or as a representative. Include the necessary authorizations if applicable.

- Review your entries carefully; if any corrections are needed after certification, follow the guidelines for amending your submission.

- Complete the submission by electronically signing the document using the 'Sign and Submit' button, completing the process.

- After submission, you can save changes, download, or share the form for your records.

Act now to fill out your RPIE FAQ form online and comply with filing requirements.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Filing taxes late in New York can incur fines that escalate the longer you delay. The penalty amounts vary depending on the amount due and how late you file. Additionally, you’ll likely face accrued interest on the unpaid amount, making timely submissions crucial. For specific details, consult the NYC RPIE FAQ for updates on deadlines and penalties.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.