Loading

Get Mi Pr4113 2017-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MI PR4113 online

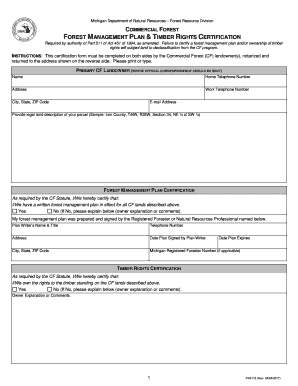

Filling out the MI PR4113 form is a crucial step for commercial forest landowners to certify their forest management plan and timber rights. This guide provides a clear and systematic approach to assist you in completing the form accurately and efficiently.

Follow the steps to complete the MI PR4113 online.

- Click ‘Get Form’ button to access the MI PR4113 certification form and open it in your web browser.

- Enter your primary contact information in the designated fields. This includes your name, home and work telephone numbers, complete address, city, state, ZIP code, and email address.

- Provide a legal land description of your parcel as specified. Use a consistent format such as 'Iron County, T46N, R35W, Section 34, NE ¼ of SW ¼'.

- Under the forest management plan certification section, indicate whether you have a written forest management plan in effect for all CF lands described above by selecting either 'Yes' or 'No'. If 'No', please provide an explanation.

- Fill out the plan writer’s details if applicable. Include their name, title, telephone number, address, date the plan was signed, and Michigan Registered Forester Number if relevant.

- In the timber rights certification section, indicate if you own the rights to the timber standing on the CF lands by selecting 'Yes' or 'No'. If 'No', explain the situation.

- Sign the form in the designated area. All owners must sign in the presence of a notary public. Ensure the signatures are dated and include the city and state where signed.

- Complete the notary section, including the notary name, signature, address, expiration date of the notary's commission, and the county where the notary is acting.

- Review the entire form for accuracy and completeness. Once confirmed, save your changes, download, print, or share the completed form as needed.

Complete your MI PR4113 certification online today to ensure compliance with forest management regulations.

The total number of exemptions you need for your W4 in Michigan should reflect your personal and financial situation. You can typically claim one exemption for yourself and additional exemptions for dependents. The aim is to balance your withholdings without overpaying or underpaying taxes. MI PR4113 can offer additional information tailored to your specific circumstances.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.