Loading

Get Mi Miucc7 2009-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MI MIUCC7 online

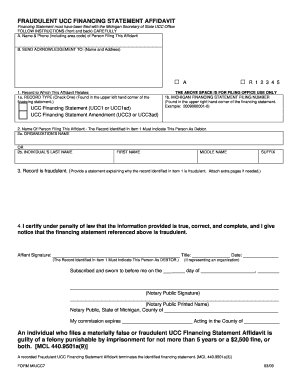

Filling out the MI MIUCC7 is a crucial step in addressing fraudulent UCC financing statements. This guide will provide you with a clear, step-by-step approach to complete the form accurately and effectively.

Follow the steps to effectively complete the MI MIUCC7 form.

- Click 'Get Form' button to obtain the MI MIUCC7 form and access it in the online editor.

- Enter the name and phone number, including area code, of the person filing this affidavit in section A. This information is crucial for contact purposes.

- In section B, provide the name and mailing address where you would like the acknowledgment of your affidavit filing to be sent.

- For item 1a, check the appropriate box to indicate the record type you are addressing — either 'UCC Financing Statement' or 'UCC Financing Statement Amendment.' This can be found in the upper left corner of the financing statement.

- In item 1b, input the Michigan financing statement filing number, which is located in the upper right corner of the financing statement. Make sure to enter only one filing number as this affidavit must relate to a single financing statement.

- For item 2, state the name of the person filing the affidavit. If the filer is an organization, fill out section 2a; if an individual, fill out sections 2b (last name, first name, middle name).

- In item 3, provide a statement explaining why the record identified in item 1 is fraudulent. This may require additional pages if you need more space.

- In item 4, carefully read the certification statement. If you agree, sign and date the affidavit. If you are signing on behalf of an organization, include your title.

- Remember not to insert anything in the upper right section of the form, as it is meant for filing office use only.

- Once completed, submit the MI MIUCC7 affidavit to the Michigan Department of State UCC Office at the specified mailing address.

- As a final step, you can save your changes, and choose to download, print, or share the completed form.

Complete the MI MIUCC7 form online today to address any fraudulent financing statements effectively.

Michigan state income tax withholding is calculated based on your income level and the allowances you claim on your W4 form. Employers use tables provided by the state to determine the correct withholding amount. Understanding this calculation helps manage your tax situation effectively. For further assistance, uslegalforms offers tools aligned with MI MIUCC7 that can help clarify these details.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.