Get Mi Filing Instructions For Principal Residence/qualified Agricultural Appeal

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MI Filing Instructions for Principal Residence/Qualified Agricultural Appeal online

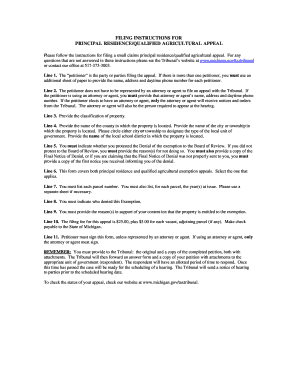

This guide provides clear instructions on how to complete the MI Filing Instructions for Principal Residence/Qualified Agricultural Appeal online. Whether you are new to the process or have prior experience, this step-by-step breakdown will support you in filling out the necessary information accurately.

Follow the steps to complete the form successfully.

- Press the ‘Get Form’ button to obtain the document and open it for editing.

- In Line 1, enter the name, address, and daytime phone number of the petitioner. If there are multiple petitioners, use an additional sheet to include their information.

- In Line 2, indicate whether you are represented by an attorney or agent. If you are, provide their name, address, and daytime phone number. Note that only the attorney or agent will receive notices and orders from the Tribunal.

- In Line 3, provide the classification of the property in question.

- In Line 4, enter the county name, the city or township name, and circle whether it is a city or township. Also, provide the local school district name.

- In Line 5, indicate if you protested the Denial of the exemption to the Board of Review. If not, explain your reasons and include either the Final Notice of Denial or the first notice received.

- In Line 6, specify whether you are appealing for principal residence or qualified agricultural exemption.

- In Line 7, list each parcel number and the year(s) related to the appeal, using a separate sheet if necessary.

- In Line 8, indicate who denied the exemption.

- In Line 9, provide reasons supporting your contention that the property qualifies for the exemption.

- In Line 10, note that a filing fee of $25.00 is required, with an additional $5.00 for each vacant adjoining parcel. Make the check payable to the State of Michigan.

- In Line 11, ensure the form is signed by the petitioner unless represented by an attorney or agent.

- Make sure to submit the original and a copy of the completed petition, along with any attachments, to the Tribunal.

- After submission, await the respondent's answer and check the status of your appeal as necessary.

Complete your MI Filing Instructions for Principal Residence/Qualified Agricultural Appeal online today to ensure your appeal is filed promptly.

To qualify for a farm tax exemption in Michigan, you must demonstrate that your property is used for agricultural purposes and meets state criteria. This includes actively farming the land or producing agricultural products. Understanding the requirements can be complex, which is why utilizing resources like the MI Filing Instructions for Principal Residence/Qualified Agricultural Appeal and platforms such as uslegalforms can be beneficial.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.