Loading

Get La Sup/f036 2002-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the LA SUP/F036 online

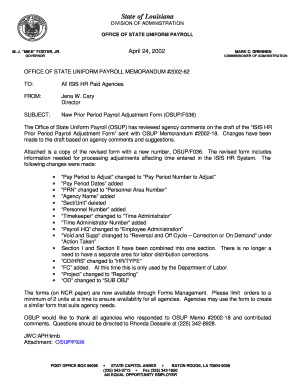

The LA SUP/F036 form is essential for processing prior period payroll adjustments within the State of Louisiana. Completing this form accurately is crucial for ensuring that payroll records reflect the correct information, supporting adjustments efficiently.

Follow the steps to fill out the LA SUP/F036 form online.

- Press the ‘Get Form’ button to acquire the form and open it in your preferred editor.

- Enter the pay period number to adjust in the designated field. This identifies the specific pay period needing correction.

- Fill in the pay period dates correlating with the pay period number you specified in the previous step.

- Input the personnel area number in the relevant field, ensuring that it matches the details from your agency.

- Provide your agency name in the next section to clarify which agency the adjustment pertains to.

- In the ‘Employee Administration Entry Only’ section, enter the employee's name and their social security number for accurate record-keeping.

- Complete the time administrator's name and number to ensure that the appropriate individual oversees and verifies the payroll adjustment.

- Indicate the action taken by selecting either ‘Correction’ or ‘On Demand’ under the ‘Action Taken’ section.

- Fill in the current pay period/number to clarify the adjustment’s context.

- List each date to be adjusted along with the original data entered and the correct data in the respective fields.

- Please ensure all entries are accurate, sign off on the form, and certify that the information is supported by appropriate documentation before submission.

- Once completed, save your changes, download, print, or share the form as needed.

Complete your documentation process online to ensure timely payroll adjustments.

The deadline to file state taxes in Louisiana coincides with the federal deadline, usually falling on April 15. However, always check for any updates or changes to this date. Staying informed about this deadline is essential for your compliance with LA SUP/F036.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.