Loading

Get In Incentive Application Hvac Install 2013-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IN Incentive Application HVAC Install online

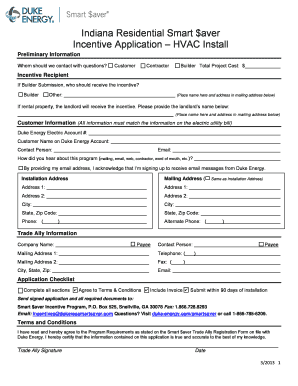

Completing the Indiana Residential Smart $aver Incentive Application for HVAC installation is an essential step towards receiving financial incentives for energy-efficient upgrades. This guide will provide clear instructions to help users navigate each section of the application effectively.

Follow the steps to complete your application accurately.

- Click ‘Get Form’ button to initiate the process and open the application form.

- Begin by filling in the preliminary information, including the total project cost and the incentive recipient's details. Specify whether the submission is made by the customer, contractor, or builder.

- Provide accurate customer information that matches the electric utility bill. This includes the Duke Energy Electric Account number, customer name, and contact details.

- Complete the installation address and mailing address sections, ensuring all addresses are clearly stated and accurate.

- Enter the trade ally information, including the company name, payee information, and contact details. This section ensures that the application is processed with the appropriate partners.

- Review the application checklist. Confirm that all sections are completed, terms and conditions are agreed upon, and the invoice is included.

- Make sure to submit the signed application along with all required documents within 90 days of installation to the address provided.

- Finally, you can save your changes, download a copy, print the application, or share it as needed to ensure successful submission.

Complete your application online today to take advantage of the available incentives.

To file for an HVAC tax credit, gather all necessary documentation, including receipts and energy efficiency certifications. Then, fill out the appropriate forms noted in the IN Incentive Application HVAC Install guide. If needed, consider using platforms like uslegalforms to streamline your filing process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.