Loading

Get Il Ld A 242.2 2014-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IL LD A 242.2 online

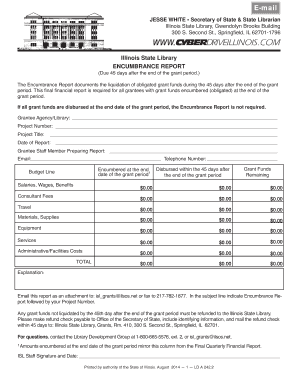

The IL LD A 242.2 form is essential for documenting the liquidation of obligated grant funds following the end of a grant period. This guide provides clear, step-by-step instructions on how to complete the form online, ensuring that users, regardless of their legal background, can navigate the process easily.

Follow the steps to effectively complete the IL LD A 242.2 form online.

- Press the ‘Get Form’ button to access the form and open it in your preferred online editor.

- Begin filling out the form by entering the Grantee Agency or Library name in the designated field.

- Input the Project Number in the next section, ensuring it is accurate to maintain proper records.

- Provide the Project Title in the appropriate field, as this will help identify the specific project related to the report.

- Enter the Date of Report to indicate when you are submitting this encumbrance report.

- Fill in the name of the Grantee Staff Member Preparing Report, along with their email and telephone number to facilitate communication.

- For each Budget Line item, enter the encumbered amount at the end date of the grant period. Follow the same process for Disbursed amounts during the 45-day period.

- Review the total amounts for Grant Funds Remaining to ensure accuracy before submission.

- If there are any explanations required for the amounts reported, document them in the Explanation section as needed.

- Finally, save your changes, and opt to download, print, or share the completed form as required.

Complete your IL LD A 242.2 form online today for timely submission.

If you earned income from Illinois sources while residing in another state, you likely need to file a non-resident tax return. Staying compliant is crucial to avoid penalties. For guidance on how this relates to IL LD A 242.2, consider exploring tools available on uslegalforms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.