Get Il Ld A 240 2013-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IL LD A 240 online

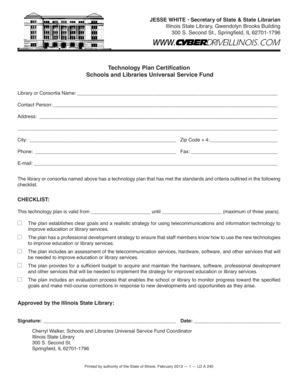

The IL LD A 240 form is essential for libraries and consortia seeking to certify their technology plans. This guide provides clear, step-by-step instructions to help you easily complete and submit the form online.

Follow the steps to successfully fill out the IL LD A 240.

- Press the ‘Get Form’ button to access the document and open it in your preferred online editor.

- In the ‘Library or Consortia Name’ field, provide the official name of the library or consortia applying for certification.

- Enter the ‘Contact Person's’ name responsible for the application, ensuring accurate contact information.

- Complete the ‘Address’ section with the physical address of the library or consortia, including city and zip code. Ensure all details are correct for correspondence.

- Fill in the ‘Phone’ and ‘Fax’ fields with accurate contact numbers. Include the area code for clarity.

- Input a valid email address in the ‘E-mail’ section to facilitate electronic communication.

- On the checklist, indicate that your technology plan is valid for a specified period by filling in the start and end dates, not exceeding three years.

- Review each checklist item to confirm that your technology plan meets all required standards and checkboxes. Consider providing additional details where necessary.

- Obtain the necessary signature and date in the ‘Approved by the Illinois State Library’ section, ensuring it is signed by the appropriate authority.

- After completing the form, save your changes. You may download, print, or share the completed form as required.

Complete your IL LD A 240 form online today to ensure your technology plan is certified.

Related links form

If you earn income from Illinois but reside in another state, you will need to file a non-resident tax return. The IL LD A 240 outlines the specific criteria for non-resident filing, ensuring you meet all obligations. It is essential to understand the nuances of your situation, as this can impact your potential tax liability. To navigate this process effectively, check out the resources offered by uslegalforms, designed to support you with non-resident tax filings.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.