Loading

Get Co Wt-2 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CO WT-2 online

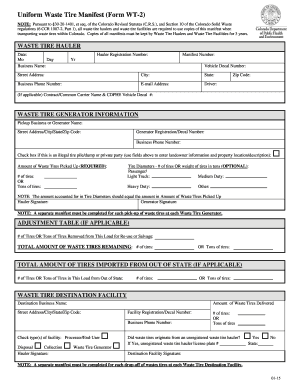

The CO WT-2 form, also known as the Uniform Waste Tire Manifest, is an essential document for reporting the transportation of waste tires in Colorado. Understanding how to accurately complete this form online is vital for waste tire haulers and facilities to comply with state regulations.

Follow the steps to fill out the CO WT-2 form accurately

- Click ‘Get Form’ button to acquire the CO WT-2 and open it in the designated editor.

- Fill in the date of the transportation in the designated mo/day/yr format, followed by entering the business name of the waste tire hauler.

- Provide the hauler registration number and manifest number, then enter the vehicle decal number.

- Complete the hauler's street address, city, state, zip code, and business phone number.

- Input the email address of the hauler, followed by the name of the driver.

- If applicable, include the name of the contract/common carrier and their CDPHE vehicle decal number.

- Next, enter the waste tire generator information, including their name and address in the necessary fields.

- Complete the generator registration/decal number and business phone number.

- If the waste tire pile is illegal or the generator is a private party, check the relevant box and provide detailed property information.

- Indicate the amount of waste tires picked up, specifying either the number of tires or tons.

- Optionally, record the tire diameters or weight of tires in tons, ensuring that the amounts match those indicated in the previous step.

- Both the hauler and generator should sign in the designated signature fields.

- If applicable, fill out the adjustment table with any changes in the number or tons of tires removed for reuse or salvage.

- Record the total amount of waste tires remaining and the total amount of tires imported from out of state if required.

- Complete the waste tire destination facility information, including the destination business name, address, facility registration number, and phone number.

- Check the appropriate types of facility (processor/end-user, collection, disposal).

- Both hauler and destination facility representatives should sign in their respective signature fields.

- Finally, save your changes, download a copy of the completed form, print it for your records, or share it as necessary.

Complete your CO WT-2 document online to ensure compliance with waste tire transportation regulations.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

To ensure your W-2 is correctly filled out, double-check the employee and employer names, Social Security numbers, and earnings data. Use the precise figures from your payroll records to avoid discrepancies. If you want to simplify this process, consider using services like uslegalforms, which can guide you in filling out the CO WT-2 accurately.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.