Get Ca Hfa Form 710

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA HFA Form 710 online

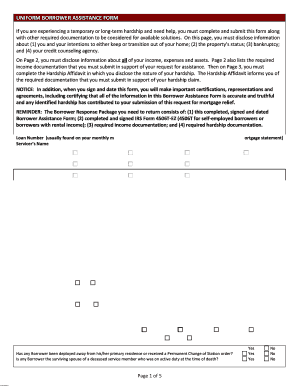

Completing the CA HFA Form 710 online is an essential step for individuals experiencing financial hardship seeking mortgage relief. This guide provides you with clear, step-by-step instructions tailored to assist you in successfully filling out the form.

Follow the steps to complete the CA HFA Form 710 online

- Use the ‘Get Form’ button to access the CA HFA Form 710 and open it in the online editor.

- Enter your loan number, which can typically be found on your monthly mortgage statement.

- Provide the servicer’s name along with your intentions concerning the property: whether you intend to keep, vacate, or sell it.

- Indicate the current status of the property by selecting whether it is your primary residence, a second home, or an investment property.

- Disclose how the property is occupied—by you, a renter, or if it is vacant.

- Fill in the personal information fields for the borrower and co-borrower, including names, social security numbers, birth dates, and contact numbers.

- Specify the mailing address and property address, if they differ.

- Respond to questions regarding whether the property is listed for sale and provide relevant dates and offer amounts if applicable.

- List your monthly household income, including wages, benefits, and other sources.

- Detail your monthly household expenses such as mortgage payments, taxes, and insurance.

- Complete the Hardship Affidavit, outlining the nature of your hardship and selecting the appropriate category.

- Read and acknowledge the certifications and agreements required at the end of the form, ensuring all information is accurate.

- Finally, save the changes made to the form, and utilize the options to download, print, or share the completed document.

Begin the process of completing your CA HFA Form 710 online today to access available assistance.

Writing a hardship letter for loss mitigation involves clearly explaining your financial situation and the challenges you face. Start by detailing your current circumstances, including job loss or unexpected expenses, and express how these issues have affected your ability to make mortgage payments. Incorporate relevant information such as your completed CA HFA Form 710 to support your request for assistance.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.