Get Or 731-0489 2017-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the OR 731-0489 online

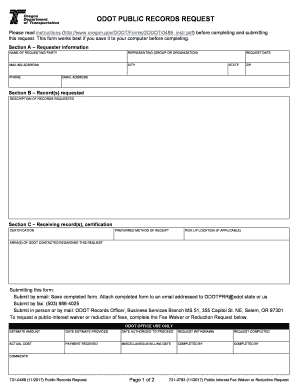

Filling out the OR 731-0489 form is an essential step for users wishing to request public records from the Oregon Department of Transportation. This guide provides a clear and systematic approach for completing the form online, ensuring that all necessary information is accurately captured.

Follow the steps to successfully complete your public records request form.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

- In Section A, fill out the requester information. Include your name, the organization you represent, mailing address, city, state, ZIP code, phone number, email address, and request date.

- Proceed to Section B and describe the records you are requesting. Be as specific as possible to ensure accurate processing of your request.

- In Section C, indicate how you would like to receive the records. Provide any preferred location for pickup if applicable and list the areas of ODOT you have contacted regarding this request.

- After completing the form, save your changes. You can then submit the completed form by email, fax, or in-person/mail to the appropriate address as provided in the instructions.

- For users requesting a public-interest waiver or fee reduction, ensure you complete the additional Fee Waiver or Reduction Request form with the necessary details.

- Finally, review the entire document for accuracy before submitting, ensuring all sections are filled correctly.

Encourage others to complete their documents online for a streamlined experience.

To find your 5 digit PIN for taxes, check your previous year’s tax return where the PIN is usually located. If you cannot find it, visit the IRS website and select the option for retrieving your PIN securely. It's crucial for tax preparation and filing, so ensure you keep this information safe for future use. If you require additional help, OR 731-0489 serves as a reliable resource.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.