Get Il Rt Ds 38.21 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IL RT DS 38.21 online

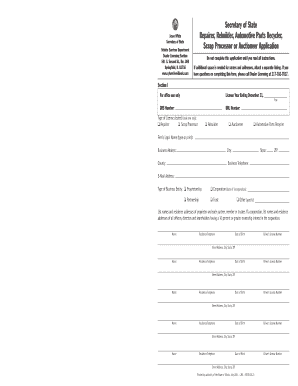

Filling out the IL RT DS 38.21 form is an essential step for those applying for a repairer, rebuilder, automotive parts recycler, scrap processor, or auctioneer license in Illinois. This guide provides a comprehensive overview of how to complete the form conveniently online, ensuring that users adhere to all requirements and instructions.

Follow the steps to complete the IL RT DS 38.21 form accurately.

- Click the ‘Get Form’ button to obtain the IL RT DS 38.21 form and open it in the online editor.

- Begin by filling out the fee schedule section. Ensure to select the appropriate fees applicable to your application type. Note the annual fee for the certificate of authority is $50 and additional fees may apply based on your business activities.

- Move to Section I. Provide your firm’s legal name and type of business entity, selecting from the available options such as proprietorship, partnership, or corporation.

- Proceed to Section II. Here, indicate whether you have been licensed under Chapter 5 of the Illinois Vehicle Code in the previous year. If applicable, provide your license number.

- In Section III, answer questions regarding any prior denial, revocation, or suspension of your application, and initial the affidavit confirming your understanding of the Illinois Vehicle Code.

- List the names and addresses of all proprietors, partners, or principal individuals in the business. Including dates of birth and driver’s license numbers as required.

- Finalize by reviewing your entries for accuracy. Save your changes, and choose to download or print the completed form for submission.

- Once the form is completed, send it along with any required attachments to the Secretary of State Vehicle Services Department, ensuring it reaches the provided address.

Complete your IL RT DS 38.21 form online today to ensure your application process is smooth and efficient.

Get form

You must file your Illinois estate tax return with the Illinois Department of Revenue if you are handling an estate subject to taxation. The necessary forms can be obtained online or through local offices, where you can also receive assistance. Ensure to file within the mandated deadlines to avoid penalties. Utilizing services such as US Legal Forms can provide you with the necessary forms and guidance for a smooth filing experience.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.