Loading

Get Ct R-114 2001-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CT R-114 online

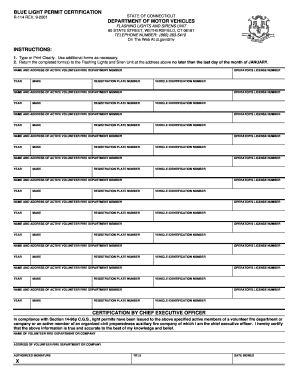

Filling out the CT R-114 form, also known as the blue light permit certification, is a straightforward process. This guide will provide you with step-by-step instructions to help you accurately complete the form online.

Follow the steps to fill out the CT R-114 form online.

- Click ‘Get Form’ button to obtain the form and open it in your preferred online document editor.

- Begin by clearly entering the operator's license number in the designated field. This information identifies the individual requesting the certificate.

- Provide the name and address of the active volunteer fire department member. Ensure that this information is accurate and written clearly.

- Fill in the year of the vehicle associated with the request, followed by the make of the vehicle.

- Enter the registration plate number of the vehicle in the specified section.

- Record the vehicle identification number (VIN) in the appropriate field. This is crucial for accurately identifying the vehicle.

- If you need to provide information for multiple vehicles, repeat steps 2 through 6 for each additional vehicle by using the additional fields available.

- When all fields are filled out, select the certification by chief executive officer section. Ensure the name of the volunteer fire department or company is entered accurately.

- The authorized signature section must be signed by the chief executive officer of the fire department. Include their title and the date the form is signed.

- Once all information is completed and double-checked for accuracy, save your changes. You can download, print, or share the form as needed.

Complete your CT R-114 form online to ensure a smooth application process.

To submit FinCEN Form 114, you must complete it through the BSA E-Filing System online. Be sure to have all required information regarding your foreign accounts and file before the deadline to avoid penalties. Platforms like uslegalforms facilitate this process, ensuring compliance with CT R-114 requirements.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.