Loading

Get Ct L-5 2001

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CT L-5 online

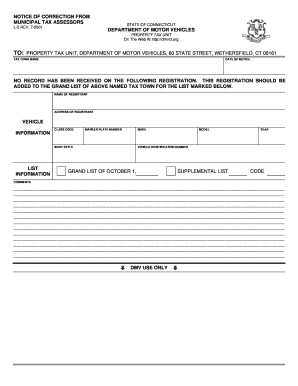

Filling out the CT L-5 form online is an important step in ensuring accurate property tax records. This guide will provide clear instructions on how to complete each section of the form efficiently and effectively.

Follow the steps to complete the CT L-5 form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the tax town name in the designated field, ensuring accuracy to avoid issues with processing.

- Input the date of the notice in the corresponding field using the format MM/DD/YYYY.

- In the 'Name of registrant' section, provide the complete legal name of the individual or entity responsible for the vehicle registration.

- Fill in the 'Address of registrant' field with the current residential or business address associated with the registrant.

- Select the vehicle class code from the options provided, which categorizes the type of vehicle being registered.

- Enter the marker plate number exactly as it appears on the vehicle's registration.

- Specify the make of the vehicle by entering the manufacturer's name.

- Provide the model of the vehicle to ensure it can be accurately identified.

- Input the year of manufacture for the vehicle, indicating when it was produced.

- Fill in the body style of the vehicle, such as sedan, coupe, SUV, etc.

- Enter any additional list information that may be required for record-keeping or clarification.

- Include the Vehicle Identification Number (VIN), ensuring that all digits are correct for proper identification.

- Specify the grand list date by indicating October 1 of the relevant tax year.

- If there are comments or additional notes to be made, use the comments section to provide this information.

- After completing all fields, review the form thoroughly for accuracy before saving any changes, and then choose to download, print, or share the completed form as needed.

Complete your forms online today to ensure timely and accurate processing.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Filing sales tax in Connecticut requires completing the CT L-5 form, detailing your sales history accurately. You can file this form online for a quicker process, ensuring all your figures are correct. The US Legal Forms platform provides easy-to-use templates, making this task more manageable for business owners.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.