Loading

Get Ct L-4 2001-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CT L-4 online

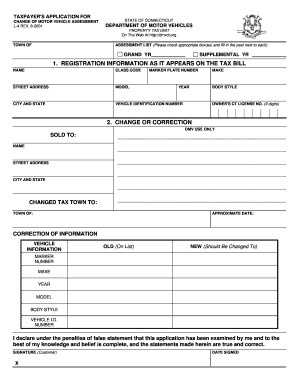

Filling out the CT L-4 form is essential for taxpayers seeking to change their motor vehicle assessment in Connecticut. This guide provides a step-by-step approach to ensure you complete the form accurately and efficiently.

Follow the steps to accurately complete the CT L-4 form online.

- Click the ‘Get Form’ button to access the CT L-4 form and open it in the online editor.

- Begin filling out the registration information as it appears on the tax bill. Enter your name, class code, marker plate number, street address, model, city and state, vehicle identification number, year, make, and body style.

- If applicable, indicate any changes or corrections in the designated section. Fill in the name of the person it was sold to, their street address, city and state, and the new tax town if it has changed.

- Provide the approximate date of the change along with the old and new vehicle information. Enter the marker number, make, year, model, body style, and vehicle identification number as necessary.

- Conclude by reviewing the declaration statement. Ensure that all information is accurate and complete. Sign and date the application to confirm your declarations.

- After finalizing your entries, save your changes. You can then choose to download, print, or share the completed form.

Complete your CT L-4 form online today for a smooth assessment change.

CTLA-4 is produced by activated T cells, particularly during an immune response. Once stimulated, these T cells express CTLA-4, which then interacts with other immune components. This production is essential for maintaining immune homeostasis and preventing overactivity.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.