Loading

Get Ct K-6 2002-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CT K-6 online

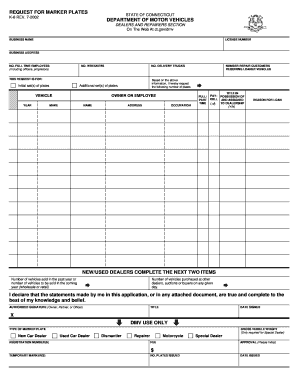

Filling out the CT K-6 form is a straightforward process for individuals and businesses requesting marker plates. This guide will walk you through each step of the online completion process to ensure accuracy and efficiency.

Follow the steps to successfully complete the CT K-6 form online.

- Click the ‘Get Form’ button to obtain the CT K-6 form and open it for online editing.

- Enter your license number at the top of the form, which is essential for identifying your business.

- Provide your business name and business address in the designated fields to ensure proper processing.

- Indicate the total number of full-time employees, including officers and proprietors, to give an overview of your business size.

- List the number of wreckers and delivery trucks your business operates, as this information is relevant to processing the request.

- Select the type of request: initial set(s) of plates or additional set(s) of plates. Specify the quantity required.

- Fill in details for the vehicle including make and model, if applicable, along with the name of the owner or employee related to the request.

- Indicate the number of repair customers requiring loaner vehicles to provide context for your request.

- Provide your occupation and title within the business to clarify your role in this request.

- State the reason for the loan if applicable to your request.

- If you are a dealer, complete the additional fields about the number of vehicles sold in the past year and the number of vehicles purchased from other dealers.

- Review all entries for accuracy and completeness to prevent issues with processing.

- Sign and date the form in the designated area, confirming the truth and completeness of the information provided.

- Once you have filled out the form, save any changes, and you will have the option to download, print, or share your completed CT K-6 form as needed.

Proceed to complete the CT K-6 document online today.

To get a CT K-6 teaching certificate, you must first complete an approved educator preparation program. This includes coursework, student teaching, and passing relevant exams. Afterwards, you will need to apply for your certification through the Connecticut State Department of Education, ensuring all required documents are submitted. Using services from platforms like USLegalForms can simplify this process and help you gather necessary paperwork swiftly.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.