Loading

Get Ct Au-736 2008

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CT AU-736 online

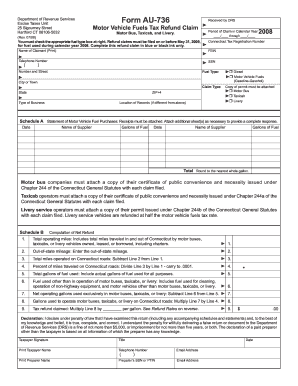

Filling out the CT AU-736 form for the motor vehicle fuels tax refund can seem daunting, but with the right guidance, users can navigate it with ease. This guide provides a step-by-step approach to effectively complete the form online.

Follow the steps to successfully submit the CT AU-736 online.

- Click ‘Get Form’ button to access the CT AU-736 and open it in your preferred online editor.

- Indicate the period of claim in the Calendar Year section. Fill in the start and end dates for the claim, ensuring accuracy.

- Enter your Connecticut Tax Registration Number, and check the appropriate box for the fuel type — either Diesel or Motor Vehicle Fuels (Gasoline-Gasohol).

- Complete the claimant's information, including name, telephone number, street address, and either FEIN or SSN.

- Select the claim type by checking the corresponding box for Motor Bus, Taxicab, or Livery. Attach any required permits or certificates.

- In Schedule A, list each motor vehicle fuel purchase by entering the date, supplier name, and gallons of fuel for each transaction. Attach all necessary receipts.

- In Schedule B, calculate the net refund. Follow the instructions carefully to complete each calculation accurately.

- Review your entries for any errors before finalizing. Once verified, save your changes.

- Download, print, or share the completed form as needed before mailing it to the Department of Revenue Services.

Complete your CT AU-736 form online to ensure a smooth filing process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Yes, Connecticut imposes a vehicle excise tax based on the assessed value of your vehicle. This tax is collected by local municipalities, and rates may vary depending on where you live. For guidance on managing tax-related documents and requirements, consider the resources available from US Legal Forms, which can clarify your obligations related to CT AU-736.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.