Loading

Get Colorado Self Form 2012-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Colorado Self Form online

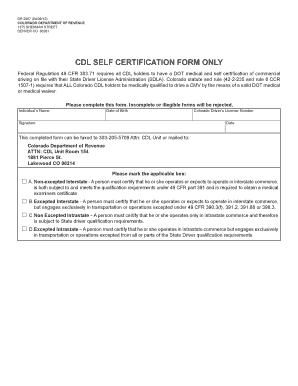

The Colorado Self Form is essential for all commercial driver's license (CDL) holders in Colorado to certify their medical and driving qualifications. In this guide, you will learn how to accurately complete this form online, ensuring compliance with federal and state regulations.

Follow the steps to complete the Colorado Self Form online flawlessly.

- Press the ‘Get Form’ button to access the Colorado Self Form and open it in your preferred editing program.

- Provide your individual name clearly in the designated field. It is crucial that this information is accurate as it must match your official documents.

- Enter your date of birth in the appropriate format, ensuring legibility to avoid rejections.

- Complete the field for your Colorado driver’s license number. This number ensures your application is linked to your driving record.

- Affix your signature to the form, confirming the accuracy of the information provided.

- Date the form by entering the current date in the specified section.

- Indicate the applicable certification box that best represents your driving operations: A, B, C, or D, based on the options given.

- Review your completed form for accuracy and legibility before finalizing.

- Once all information is verified, you can save the changes, download a copy for your records, print it for submission, or share it as needed.

Complete your Colorado Self Form online today to ensure compliance and maintain your driving privileges.

Yes, Colorado provides various state tax forms tailored for both individuals and businesses. Each form is designed to address specific tax situations and requirements. To ensure you submit the correct forms on time, resources such as Colorado Self Form can be incredibly helpful.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.