Get Co Dr 2225 2007-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CO DR 2225 online

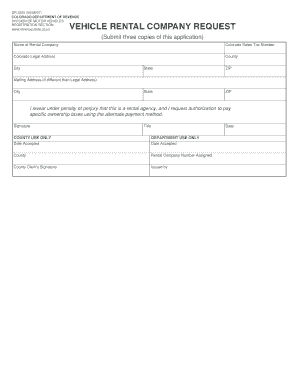

The CO DR 2225 form is a vital document for vehicle rental companies in Colorado seeking to request authorization for specific ownership tax payment methods. This guide provides clear and detailed instructions on how to complete this form online, ensuring you understand each section and field.

Follow the steps to complete the CO DR 2225 form accurately.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the name of your rental company in the designated field. This identifies your business formally.

- Input your Colorado sales tax number to ensure accurate tax reporting and compliance.

- Fill in the legal address of your company, including the street address, city, state, and ZIP code. This information is crucial for jurisdictional purposes.

- Specify the county where your rental company operates. This helps in determining local tax obligations.

- If your mailing address differs from the legal address, provide it in the corresponding fields, including the city, state, and ZIP code.

- Affirm your status as a rental agency by signing the form. You will also need to provide your title to validate your authority to submit the application.

- Leave the 'County Use Only' and 'Department Use Only' sections blank, as these fields will be completed by the appropriate authorities.

- Once you have filled out all required fields, review your entries for accuracy and completeness.

- Finally, save your changes, and then download, print, or share the form as needed.

Complete your CO DR 2225 form online today and ensure your vehicle rental company meets all necessary tax obligations.

Yes, Colorado requires a state tax withholding form for new employees and independent contractors. This form, often called Form DR 0004, helps employers determine the appropriate withholding amounts. By utilizing tools from US Legal Forms, you can easily obtain and fill out this form, making sure you meet the state’s requirements without hassle.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.