Loading

Get Ak Form 465 2009-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AK Form 465 online

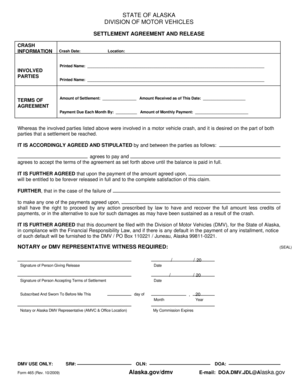

The AK Form 465 is essential for individuals involved in a motor vehicle crash who seek to reach a settlement agreement. This guide provides clear, step-by-step instructions on how to complete the form online, ensuring that all necessary information is accurately captured.

Follow the steps to complete the AK Form 465 online.

- Click ‘Get Form’ button to obtain the form and open it for completion.

- Enter the date of the crash in the designated field.

- Fill in the location of the crash, providing specific details for clarity.

- In the 'Involved Parties' section, print your name clearly as the individual involved in the accident.

- Complete the terms of the agreement by printing the names of both involved parties in their respective fields.

- Input the amount of settlement agreed upon in the designated field.

- Specify the amount received as of the current date, ensuring accuracy.

- Indicate the payment due each month and the amount of the monthly payment.

- Both parties should sign the document, providing their printed names, signatures, and the date of signing.

- If required, ensure that the form is signed in front of a notary or DMV representative, including the necessary seal.

- After completing the form, review all entries for accuracy. Users can then save changes, download, print, or share the completed form as needed.

Complete your AK Form 465 online today for a smooth settlement process.

IRS Form K is not a standalone form but often refers to various tax forms associated with certain tax credits and deductions. While it may vary based on your income type, ensure you gather the necessary documentation to support your claims. Utilizing AK Form 465 can help clarify your tax responsibilities and streamline your filing process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.