Loading

Get Pa Psrs-1259 2012-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PA PSRS-1259 online

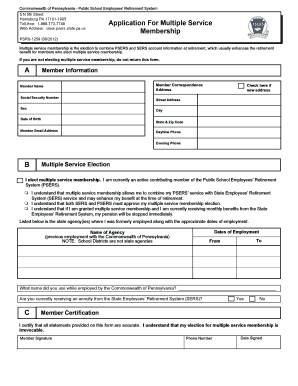

Filling out the PA PSRS-1259 form is an important step for individuals considering multiple service membership in the Public School Employees' Retirement System. This guide offers clear instructions on completing the form online to ensure a smooth process.

Follow the steps to complete the PA PSRS-1259 form online.

- Click ‘Get Form’ button to access the PA PSRS-1259 and open it in the online editor.

- Begin with the member information section. Provide your full name, social security number, date of birth, and contact information, including email and phone numbers. If your address has changed, be sure to check the appropriate box.

- In the multiple service election section, indicate your election for multiple service membership by checking the box provided, acknowledging your current active membership in PSERS and understanding the implications of combining your service with SERS.

- List the state agency where you were formerly employed in Pennsylvania, along with the approximate dates of your employment. Include both the starting and ending dates.

- Specify the name you used while employed with the Commonwealth of Pennsylvania in the designated area.

- Indicate whether you are currently receiving an annuity from SERS by selecting 'Yes' or 'No.'

- In the member certification section, confirm that all information provided is accurate. Sign the form, include your phone number, and date the signature.

- After completing all sections, save your changes. You can then download, print, or share the completed form as needed.

Complete the PA PSRS-1259 form online today to take the next step in your retirement planning.

The amount of a PA state pension can depend on various factors, primarily your salary and years of service. Many employees find that their pension reflects a significant portion of their final salary, especially under PA PSRS-1259. For a clearer understanding, consulting resources like uslegalforms can help clarify what you might expect.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.