Loading

Get Ma Ltr3101 2013-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MA LTR3101 online

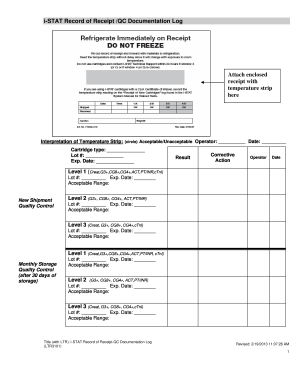

The MA LTR3101 is a vital document used for recording receipt and quality control of i-STAT cartridges. This guide will assist you in completing the form accurately and effectively, ensuring compliance with quality standards.

Follow the steps to fill out the MA LTR3101 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Attach the enclosed receipt with the temperature strip at the designated section of the form. Ensure that it is clear and legible.

- In the 'Interpretation of Temperature Strip' section, circle the appropriate option indicating whether the temperature is acceptable or unacceptable. Provide your name as the operator and the date of the analysis.

- For each cartridge type, fill in the relevant fields, including the lot number and the expiration date. Make sure to document the acceptable range for each level outlined in the form.

- Complete the 'Result' section by entering any outcomes observed during testing and specify any corrective actions taken. Write your name, the date, and level details accordingly.

- Ensure all sections are completed before finalizing the document. Review for accuracy, and make any necessary adjustments.

- Once you have filled out the form, you can save your changes, download a copy for your records, print the document, or share it if required.

Complete the MA LTR3101 online today to maintain accurate and timely records.

Filing sales tax in Massachusetts requires you to collect the appropriate sales tax from customers on taxable sales. After an accounting period, submit your sales tax return to the Massachusetts Department of Revenue, detailing the tax collected. Ensure your records are accurate to avoid discrepancies during an audit. USLegalForms can assist in gathering the right materials needed for compliance with MA LTR3101.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.