Get Tsp-1-c 2019-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TSP-1-C online

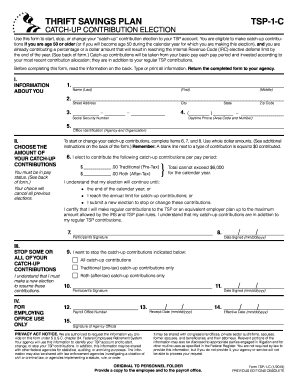

This guide provides clear and detailed instructions on how to complete the TSP-1-C form online. The TSP-1-C form is essential for initiating, modifying, or terminating your catch-up contributions to your Thrift Savings Plan account, particularly for individuals aged 50 and older.

Follow the steps to complete the TSP-1-C form effectively.

- Click ‘Get Form’ button to access the TSP-1-C form and open it in your preferred online editor.

- In Section I, provide your personal information. Enter your name, street address, city, state, zip code, social security number, and daytime phone number. Ensure all information is accurate and complete.

- Move on to Section II to choose the amount for your catch-up contributions. Indicate your desired contribution amounts for both Traditional (Pre-Tax) and Roth (After-Tax) contributions using whole dollar amounts. Remember that a blank line means a $0 contribution.

- Make sure to select the duration for your contributions, whether until the end of the calendar year, upon reaching the annual limit, or until you submit a new election. Sign in the designated area to certify your contributions.

- If you want to stop all or certain types of your contributions, navigate to Section III and select the options provided. Be sure to sign this section if applicable.

- In Section IV, while this is for office use only, you should be aware of the Receipt Date and Effective Date that will be assigned by the payroll office upon receipt of your completed form.

- After reviewing all entries for accuracy, save your changes. You may then download, print, or share the form as needed.

Complete your TSP-1-C form online today to manage your catch-up contributions effectively.

The TSP C fund may drop due to various market factors, including economic downturns, changes in interest rates, or political events. Understanding these fluctuations is crucial for making informed decisions regarding the TSP-1-C. Monitoring market conditions can help you anticipate changes and adapt your strategy accordingly. Staying educated on market trends is beneficial for all investors.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.