Loading

Get Ny Char004 2018-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY CHAR004 online

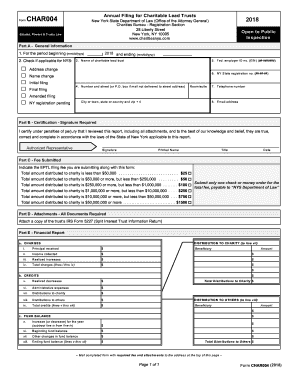

The NY CHAR004 form is essential for annual filings regarding charitable lead trusts in New York State. This guide will assist users in accurately completing the form online, ensuring compliance with state laws.

Follow the steps to complete the NY CHAR004 online seamlessly.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin with Part A - General Information. Fill in the period beginning date (mm/dd/yyyy) and ending date (mm/dd/yyyy) for the filing period.

- Provide the name of the charitable lead trust in the designated field.

- Enter your Federal Employer Identification Number (EIN) in the appropriate format (##-#######).

- If applicable, select the corresponding checkboxes to indicate if this is an address change, name change, initial filing, final filing, amended filing, or if New York registration is pending.

- Input the street address, room/suite number (if applicable), city/town, state or country, and zip code.

- Enter the telephone number and email address for contact purposes.

- Proceed to Part B - Certification. An authorized representative must review the report and provide their signature, printed name, title, and date.

- Move on to Part C - Fee Submitted. Select the appropriate fee based on the total amount distributed to charity.

- Ensure that you submit only one check or money order for the total fee, payable to 'NYS Department of Law'.

- In Part D, attach a copy of the trust’s IRS Form 5227.

- Complete Part E - Financial Report. Fill in charges, credits, and fund balances as required.

- After reviewing all entries for accuracy, save changes, download, print, or share the completed form as needed.

Complete your NY CHAR004 filing online today for a smooth compliance experience!

In New York, some organizations are exempt from registering for charitable solicitation if they meet specific criteria, such as having gross revenues below a certain threshold. Understanding the nuances of NY CHAR004 helps clarify these exemptions. It's important to ensure compliance to avoid potential issues. The uslegalforms platform can provide clear guidance on these regulations and help you determine your organization’s status.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.