Get In Sf 50469 2015-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IN SF 50469 online

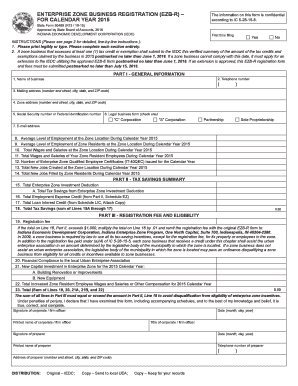

The IN SF 50469, also known as the Enterprise Zone Business Registration (EZB-R), serves as an essential document for businesses claiming tax credits and exemptions in Indiana. This guide provides a clear, step-by-step approach to help you accurately complete the form online, ensuring you meet all necessary requirements.

Follow the steps to complete the form correctly.

- Click the ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Enter the legal name of the business in the designated field.

- Provide the business telephone number, including area code, ensuring it is correct.

- Input the mailing address, including number and street, city, state, and ZIP code.

- Fill in the zone address, which should indicate the physical location in the enterprise zone.

- Enter either the Social Security number or the Federal Identification number of the business.

- Select the legal business form by checking the appropriate box for ‘C’ Corporation, ‘S’ Corporation, Partnership, or Sole Proprietorship.

- Provide your email address for communication purposes.

- Calculate and enter the average level of employment at the zone location during the calendar year.

- Complete the line for average level of employment of zone residents at the zone location.

- Enter total wages and salaries at the zone location, reflecting the full year’s data.

- Provide total wages and salaries for your zone resident employees.

- Document the number of Enterprise Zone Qualified Employee Certificates issued for the year.

- Record the total new jobs created at the zone location during the specified calendar year.

- Enter the total new jobs that were filled by zone residents during the year.

- In Part II, calculate the total Enterprise Zone Investment Deduction and record it.

- Input the total employment expense credit amount, then note the loan interest credit if applicable.

- Sum the totals from the previous lines in Part II, noting the aggregate tax savings amount.

- Determine the registration fee if tax savings exceed $1,000, and calculate one percent of the total savings.

- Finalize by reviewing all entries for accuracy, then save changes, download, print, or share the completed form as necessary.

Complete and submit the form online today to ensure compliance with Indiana’s enterprise zone requirements.

You can contact the San Francisco court via phone, email, or by visiting their website for more information. Additionally, each department has specific contact details, which can be found online for your convenience. For more streamlined communication, consider utilizing tools available on the US Legal Forms platform to assist you IN SF 50469.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.