Loading

Get Ca Form 720-21 2017-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA Form 720-21 online

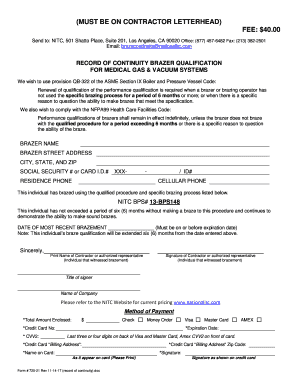

Filling out the CA Form 720-21 online is a straightforward process that requires attention to detail. This guide provides clear, step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to successfully complete the CA Form 720-21 online.

- Click ‘Get Form’ button to obtain the form and open it for editing.

- Begin by entering the brazer's name in the designated field. Ensure that the name matches the official documentation.

- Fill in the brazer's street address, followed by the city, state, and ZIP code. This information is crucial for identification purposes.

- Provide the social security number or card identification number in the specified area, ensuring accuracy.

- Input the residence phone number and cellular phone number in the corresponding fields to maintain contact.

- Enter the NITC BPS number clearly in the section provided; this is essential for tracking qualifications.

- Document the date of the most recent brazement, which must be on or before the expiration date noted on the form.

- Review all entered information for accuracy before proceeding. Make adjustments if necessary.

- Save the changes to the completed form. You may then download, print, or share the form as required.

Complete your CA Form 720-21 online today to ensure timely and accurate submission.

Any business involved in activities that incur federal excise taxes must file an excise tax return. This may relate to manufacturing, selling, or using certain products and services that the IRS regulates. Using CA Form 720-21, you can easily keep track of your excise tax obligations and simplify the filing process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.