Get Oh Collegeadvantage Withdrawal Request Form 2018-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the OH CollegeAdvantage Withdrawal Request Form online

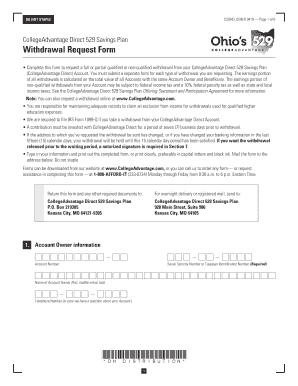

Filling out the OH CollegeAdvantage Withdrawal Request Form online can seem challenging, but with clear guidance, you can complete it efficiently. This user-friendly guide will walk you through each section of the form, ensuring you understand the requirements for a successful withdrawal request.

Follow the steps to complete the withdrawal request form

- Click ‘Get Form’ button to obtain the OH CollegeAdvantage Withdrawal Request Form and open it in the editor.

- Enter your account owner information, including your Social Security Number or Taxpayer Identification Number, account number, name, and telephone number.

- Provide the beneficiary's information by entering their name and Social Security Number or Taxpayer Identification Number.

- Select the reason for withdrawal by choosing one option from the provided list (A through F). Make sure to understand the implications of each option regarding qualified and non-qualified withdrawals.

- Indicate the amount of withdrawal by selecting either the full balance, a partial amount, or specific investment options. Ensure you review penalties associated with early withdrawals from CDs, if applicable.

- Choose your preferred delivery method for the funds, either through first-class mail, priority delivery, automated clearing house (ACH), or an alternate mailing address. Fill in the necessary details for ACH if selected.

- Sign the form to confirm your request, providing the date of your signature.

- If notarization is required due to certain conditions, sign where indicated and have a notary complete their part.

- After verifying all the provided information, save any changes, download, print, or share the completed form as needed.

Start filling out your OH CollegeAdvantage Withdrawal Request Form online today and make your withdrawal process smooth and efficient.

Yes, it is important to keep receipts for any purchases made with your 529 funds. While the OH CollegeAdvantage Withdrawal Request Form does not require immediate proof, having documentation helps maintain clarity and prevents complications with the IRS. If the funds are ever questioned, these records serve as evidence of qualified expenses.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.