Loading

Get Ct Au-736 2014-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CT AU-736 online

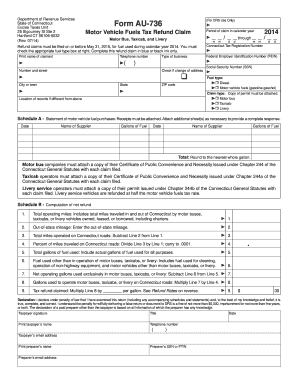

This guide provides step-by-step instructions for completing the CT AU-736 form, a tax refund claim for motor vehicle fuels. Designed for users with varying levels of experience, this guide aims to simplify the process of filing your refund claim online.

Follow the steps to complete your CT AU-736 refund claim

- Press the ‘Get Form’ button to access the CT AU-736 form and open it in your preferred online editor.

- Begin by filling out your personal information. Provide your name, telephone number, and address details in the fields designated for the claimant.

- Indicate the Connecticut Tax Registration Number, Federal Employer Identification Number (FEIN), or your Social Security Number (SSN) as required.

- Select the appropriate fuel type and claim type by checking the corresponding boxes for 'Diesel' or 'Motor vehicle fuels', and 'Motor bus', 'Taxicab', or 'Livery'.

- Complete Schedule A by entering details of your fuel purchases. Attach receipts for each purchase as required and ensure to list the date, supplier name, and gallons of fuel purchased.

- Proceed to Schedule B to compute your net refund. Fill in the total operating miles, out-of-state mileage, and calculate the relevant gallons of fuel used, applying any necessary calculations.

- Review all entered information for accuracy. Ensure that you round dollar amounts as instructed and verify that all required attachments are included.

- Save your changes, then download, print, or share the form as needed. Ensure to send the completed form to the Department of Revenue Services as directed.

Complete your CT AU-736 refund claim online today for a smoother filing experience.

In Connecticut, the diesel tax is assessed at a specific rate that applies to all diesel fuel sales. This tax is essential for funding infrastructure and maintaining public services. To better navigate the implications of diesel taxes, the CT AU-736 serves as a reliable guide, providing users with necessary details to stay informed.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.