Loading

Get Ct W-1qmb 2016-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CT W-1QMB online

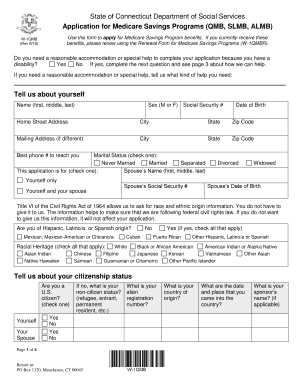

Filling out the CT W-1QMB form is an essential step for users applying for Medicare Savings Program benefits. This guide provides a clear, step-by-step approach to assist you through the online completion process.

Follow the steps to successfully complete your CT W-1QMB application.

- Press the ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by indicating whether you need any reasonable accommodations or special help due to a disability. If you require assistance, provide a description of the necessary support.

- Fill out the personal information section, including your full name, sex, social security number, date of birth, home address, mailing address (if different), and the best phone number to reach you.

- Select your marital status by checking the relevant box and indicate whether this application is for yourself only or for you and your spouse. If applicable, provide your spouse’s name, social security number, and date of birth.

- Optionally, provide information about your race and ethnic origin. This information is for compliance with federal civil rights laws and is not mandatory.

- Next, provide details about your citizenship status. Indicate if you are a U.S. citizen and, if not, specify your non-citizen status and provide required details.

- Fill out the medical insurance section by checking if you and your spouse have Medicare Part A or B. Provide insurance details, including claim numbers and policy information.

- Detail your income sources for yourself and your spouse. List the amount and frequency of income before deductions for various categories such as wages, Social Security, pensions, and other sources.

- Review the important information section carefully, noting that all information provided is confidential and will be utilized in compliance with regulations.

- Finally, sign and date the application to certify the accuracy of the information provided. If anyone assisted you, they should also sign in the designated area.

- Once all fields are completed, you can save changes, download, print, or share your completed application.

Complete your application and submit it online to access the Medicare Savings Program benefits.

The Medicare savings program works by assisting eligible individuals in paying Medicare costs, such as premiums and deductibles. When you qualify, the program can significantly decrease your out-of-pocket expenses, allowing you to access necessary medical care more affordably. The CT W-1QMB initiative focuses on helping advocates navigate these programs, ensuring you receive all the benefits available.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.