Get Ph Bir 1702-ex 2018-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PH BIR 1702-EX online

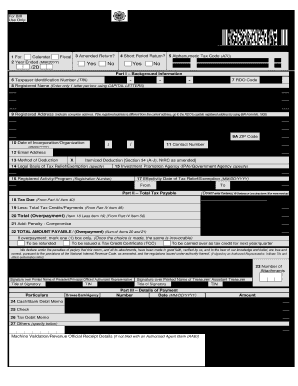

The PH BIR 1702-EX form is essential for corporations, partnerships, and non-individual taxpayers that are exempt from taxation, allowing them to report their annual income tax. This guide provides clear and supportive instructions for filling out the form online, ensuring users can complete each section accurately.

Follow the steps to complete your PH BIR 1702-EX form online.

- Click the ‘Get Form’ button to access the online BIR 1702-EX form and open it in the editor.

- Begin by filling in your Taxpayer Identification Number (TIN) in Part I, item 6. Ensure that you input the correct TIN to avoid any issues with your filing.

- Enter the RDO code in item 7, which helps to identify the revenue district of your registered address.

- Complete item 8 by writing your registered name, ensuring each letter is entered in capital letters and only one letter per box.

- Provide your registered address in item 9, including the full details. If your current address differs, you must update it through the appropriate BIR form.

- Indicate the ZIP code in item 9A, followed by the date of incorporation in item 10 using the MM/DD/YYYY format.

- Submit your contact number in item 11 and your email address in item 12 for communication purposes.

- Choose the method of deduction in item 13 by marking the applicable box for Itemized Deduction.

- Fill in any legal basis for tax relief in item 14 and designate the Investment Promotion Agency or government agency in item 15.

- Input your registered activity or program including the registration number in item 16, followed by the effectivity date of tax relief in item 17.

- Proceed to Part II for tax computations: enter the information progressively from item 18 to item 22, ensuring proper calculations.

- Complete Part III with details of payment methods in items 24 to 27 as applicable.

- In Part IV, calculate your total tax as indicated in the fields from item 28 to item 50.

- If applicable, fill out Part V regarding tax relief availment and total deductions in Part VI.

- Review your entries for accuracy. Finally, you can save changes, download, print, or share the completed form as needed.

Complete your PH BIR 1702-EX form online today to ensure accurate filing.

The term 1701 refers to the specific BIR form for individuals and sole proprietors in the Philippines to report their income for taxation purposes. It encapsulates various aspects of an individual's financial situation, ensuring accurate tax submission. Understanding the details of form 1701 is essential for individuals to avoid potential tax issues. To streamline the filing process, you may turn to USLegalForms for assistance.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.