Loading

Get Ie Form Cg1 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IE Form CG1 online

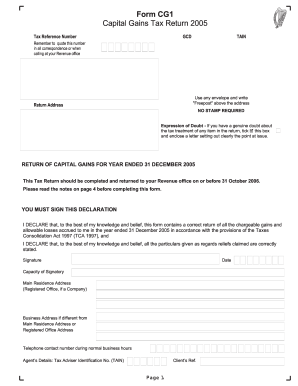

This guide provides a comprehensive overview of how to complete the IE Form CG1, specifically designed for reporting capital gains. With clear instructions, even users with limited legal experience will find the process manageable.

Follow the steps to complete the IE Form CG1 effectively.

- Click ‘Get Form’ button to obtain the form and open it for editing.

- Review the personal information section at the top of the form. Enter the Tax Reference Number, your name, and any other required identification details.

- Proceed to the section titled 'Return of Capital Gains for Year Ended 31 December 2005'. Ensure that you understand the declaration you are signing, confirming accuracy to the best of your knowledge.

- Fill out the 'Details of Disposal of Assets' section. List the types of disposals, number of disposals, aggregate area in hectares, and aggregate consideration for each asset category.

- If applicable, indicate any disposals between connected persons or those not at arm's length by ticking the relevant boxes.

- Complete the relief claims section. Indicate any reliefs you are claiming, both for yourself and for your spouse, if applicable. Specify any relevant details regarding principal private residence or retirement relief.

- Calculate the chargeable gains and any losses incurred during the year. Enter these amounts in the designated fields, making sure to differentiate between self and spouse entries.

- Review the total consideration on disposals and ensure that your calculations for tax due are completed for the applicable periods.

- If claiming a refund for any capital gains tax paid, be sure to tick the appropriate box.

- Finally, review all sections for accuracy. Save your changes, download a copy of the completed form, print it if necessary, or share it as required.

Begin filling out your IE Form CG1 online now to ensure timely submission.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

You can easily obtain your tax return forms online through the IRS website or your state’s tax authority. Additionally, platforms like uslegalforms often provide access to various tax forms, including the IE Form CG1. Using these resources simplifies the retrieval process, making it convenient for your tax preparation needs.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.