Loading

Get Canada T1213(oas) E 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada T1213(OAS) E online

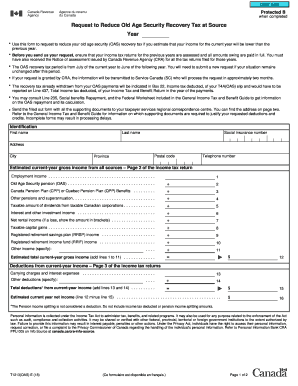

The Canada T1213(OAS) E form is used to request a reduction in Old Age Security recovery tax at source if your estimated income for the current year is lower than the previous one. This guide provides clear, step-by-step instructions on how to complete this form online.

Follow the steps to accurately complete the Canada T1213(OAS) E form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In the identification section, enter your first name, last name, social insurance number, address, city, province, postal code, and telephone number.

- Estimate your current-year gross income from all sources. Fill in the amounts for employment income, OAS pension, CPP or QPP benefits, other pensions, net rental income, taxable capital gains, RRSP income, RRIF income, and any other income. Make sure to total these amounts.

- List any deductions from your current-year income, such as carrying charges and interest expenses. Again, ensure you total these deductions.

- Calculate your estimated current-year net income by subtracting total deductions from your estimated gross income.

- Complete the non-refundable and refundable tax credits sections as applicable, indicating any amounts for disability amounts, medical expenses, charitable donations, RRSP/RRIF income tax deductions, and tax instalments paid.

- Review your entries for accuracy and completeness to avoid any processing delays.

- In the certification section, sign and date the form, certifying that the information provided is correct and complete.

- Submit the completed form, along with any supporting documents to the designated taxpayer services regional correspondence centre based on your residence.

Complete your Canada T1213(OAS) E form online today to manage your Old Age Security recovery tax efficiently.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Yes, you can collect Old Age Security (OAS) even if you live outside Canada. However, you must ensure that you meet the residency requirements set by the Canadian government. Additionally, be aware of any tax implications that may arise as part of the process, including those that relate to the Canada T1213(OAS) E. Always consult a tax professional if unsure.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.