Loading

Get Canada Rc151 E 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada RC151 E online

This guide provides a comprehensive overview of how to fill out the Canada RC151 E form online. By following these steps, you will ensure that your application for the GST/HST credit is completed accurately and efficiently.

Follow the steps to complete your application successfully.

- Click ‘Get Form’ button to access the Canada RC151 E form and open it in your preferred editor.

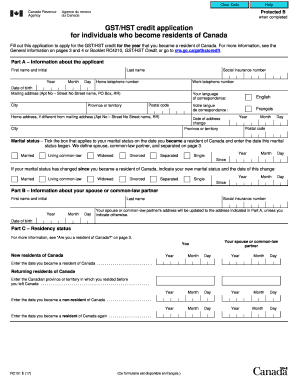

- Begin with Part A, which requests information about the applicant. Fill in your first name, last name, social insurance number, date of birth, and contact details including home and work telephone numbers.

- Complete the mailing address fields. If your home address differs from the mailing address, provide the alternate address too.

- Indicate your language of correspondence by selecting either English or French.

- Specify your marital status at the time you became a resident of Canada by ticking the appropriate box and entering the date this status began.

- If your marital status has changed since becoming a resident, indicate your new status and the date of this change.

- Part B requires information about your spouse or common-law partner. Enter their first and last name, social insurance number, date of birth, and confirm their address.

- In Part C, detail your residency status. Enter the important dates related to your residency status, including the date you became a resident of Canada.

- Part D focuses on your statement of income. Fill out the income details for the year you became a resident and the previous two years if applicable.

- Finally, in Part E, certify that all information provided is correct by signing and dating the form for both you and your spouse or common-law partner.

- Once completed, save your changes, and choose to download, print, or share the form as required.

Start completing your Canada RC151 E form online today!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Eligibility for the GST credit in Canada typically depends on your income level, age, and family situation. Individuals or families whose earnings fall below given thresholds can qualify for this tax relief. The Canada RC151 E form provides further details on how to ensure you meet the necessary criteria.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.