Loading

Get Canada Mbt-rl1 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

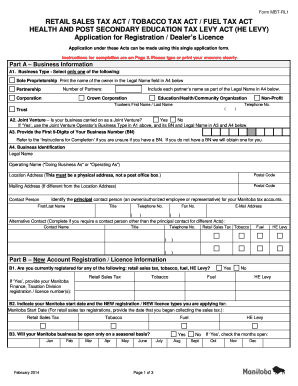

How to fill out the Canada MBT-RL1 online

This guide provides users with clear and concise instructions for filling out the Canada MBT-RL1 application form online. By following the outlined steps, users can ensure that their applications are completed accurately and efficiently.

Follow the steps to successfully complete the Canada MBT-RL1 application.

- Click ‘Get Form’ button to access the MBT-RL1 application form and open it in your preferred online editor.

- Provide your business information in Part A. Select your business type (e.g., sole proprietorship, partnership, corporation) and fill in your business name and operating name in sections A3 and A4.

- In section A2, indicate whether your business operates as a joint venture. If yes, include the joint venture operator’s details.

- Enter your Business Number (BN) in section A3. If you do not have a BN, the system will assist you in obtaining one.

- Fill in your business identification details, including the legal name, location address (must be physical), and mailing address if different. Include contact details for the primary contact person.

- For Part B, answer whether you are currently registered for any tax type (retail sales tax, tobacco, fuel, HE Levy) in section B1 and provide any registration numbers if applicable.

- Indicate your Manitoba start date for business activities and the new registration or license types you are applying for in section B2.

- Describe your business activities in section B4, including the type of business and estimated monthly sales tax remittance. If applicable, disclose any goods purchased for personal use.

- Complete section B5 by indicating what products you intend to sell, including liquor, tobacco, and fuel, and check all applicable categories.

- Finalize your application by certifying your information in Part C, providing the necessary signature, printed name, title, and date.

- After completing the form, save your changes. You can download, print, or share the completed form as needed.

Complete your application for the Canada MBT-RL1 online today for a smoother registration process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To file common law taxes in Canada, begin by gathering all necessary income documents, including T1 or RL-1 slips as applicable. Next, determine your eligible deductions and complete your tax return accordingly. Joint filing is possible for common-law couples, which may result in tax benefits. For further support, USLegalForms can guide you on the Canada MBT-RL1 process.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.