Get Canada Gst523-1 E 2018-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada GST523-1 E online

This guide provides a comprehensive overview of how to complete the Canada GST523-1 E form, aimed at non-profit organizations seeking to claim a public service bodies' rebate. By following these clear steps, users with varying levels of experience can successfully navigate the online filing process.

Follow the steps to complete your Canada GST523-1 E form online.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

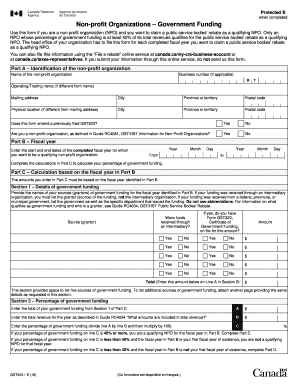

- In Part A, enter the identification details of your non-profit organization. Fill in your organization's name, business number if applicable, operating or trading name if different, mailing address, city, province or territory, and postal code. Also indicate the physical location if it differs from the mailing address.

- Answer whether this form amends a previously filed GST523. Indicate if you are a non-profit organization, as defined in Guide RC4081.

- In Part B, provide the start and end dates of the completed fiscal year for which you are claiming the rebate.

- Move to Part C for calculations; in Section 1, list the details of government funding sources for the fiscal year stated in Part B, including whether the funds were received through an intermediary and provide the corresponding amounts.

- In Section 2 of Part C, calculate the total government funding, total revenue, and the percentage of government funding. Ensure the calculated percentage is at least 40% to qualify.

- If needed, complete Part D based on earlier fiscal years if your percentage was below 40%. List the government funding sources for the previous years as applicable.

- In Part E, certify the information provided by filling in the authorized person's name, signing, and adding their title and contact number.

- Finally, review your entries for accuracy. Save your changes, and you may choose to download, print, or share the completed form.

Start your online application for the Canada GST523-1 E form today!

The 90% rule states that non-residents must stay in Canada for at least 90 days during the tax year to be eligible for certain benefits. This rule affects tax obligations and eligibility for deductions. Understanding the details of the 90% rule can help you navigate your responsibilities. For more information, refer to descriptions such as Canada GST523-1 E to grasp how this rule might impact you.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.