Loading

Get Canada Gst190 E 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada GST190 E online

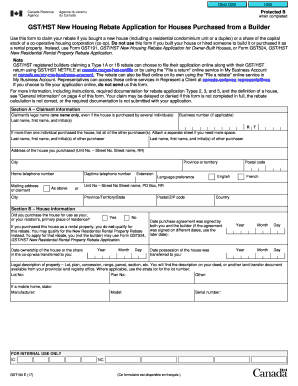

This guide provides a clear and systematic approach to completing the Canada GST190 E form online. It is designed to assist users, regardless of their experience, in successfully claiming the GST/HST new housing rebate for eligible purchases.

Follow the steps to complete your Canada GST190 E form accurately:

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Carefully complete Section A, 'Claimant Information,' by providing your legal name, business number if applicable, home address, and contact details. Ensure you include any additional purchasers if applicable.

- In Section B, 'House Information,' answer whether the house is your primary residence and provide important dates related to your ownership and possession of the house.

- Fill out Section C, 'Housing and Application Type,' by selecting the type of housing you purchased and the corresponding application type. Review your options carefully to ensure accuracy.

- Complete Section D, 'Builder or Co-op Information,' supplying the builder's legal name, business number, address, and confirming if the builder has paid or credited the rebate directly.

- In Section E, 'Claimant's Certification,' sign and certify that all information provided is accurate and complete.

- Proceed to Section F, 'Rebate Calculation,' and fill in the appropriate section based on your application type. It may require calculations from the GST190 calculation worksheet.

- For those filing a Type 2, 3, or 5 application, complete Section G with your direct deposit information to facilitate an electronic refund.

- Review all sections for accuracy before saving changes, downloading, printing, or sharing the completed form as necessary.

Begin your online application for the Canada GST190 E form today to take advantage of the housing rebate.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Yes, a customs declaration form must be filled out when bringing items into Canada. This form informs customs about the goods you are carrying and whether they are subject to tax or duty. Properly filling out this form helps in avoiding delays and ensures compliance with customs regulations.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.