Loading

Get Alberta At1 Schedule 1 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Alberta AT1 Schedule 1 online

This guide provides clear and supportive instructions on how to complete the Alberta AT1 Schedule 1 online. By following these steps, users can efficiently navigate the form and ensure all necessary information is accurately reported.

Follow the steps to fill out the Alberta AT1 Schedule 1 online efficiently.

- Click the ‘Get Form’ button to obtain the Alberta AT1 Schedule 1 form and open it in the editor.

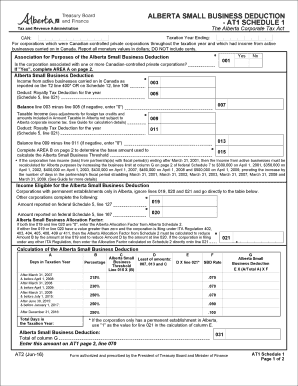

- Identify the taxation year ending in the designated field at the top of the form. Make sure to use the correct year as this is crucial for accurate reporting.

- In section 001, determine whether the corporation is associated with one or more Canadian-controlled private corporations. Select 'Yes' or 'No' accordingly.

- Under the Alberta Small Business Deduction section, report income from active businesses carried on in Canada on line 003. This should be taken from the T2 line 400 or Schedule 12, line 106.

- On line 005, deduct any Royalty Tax Deduction for the year as reported on Schedule 5, line 021. Calculate the balance on line 007 by subtracting line 005 from line 003. If the result is negative, enter '0'.

- In line 009, enter the taxable income, making necessary adjustments for foreign tax credits and amounts included in the taxable income.

- Again, record any Royalty Tax Deduction for the year on line 011 and compute the balance on line 013. If negative, enter '0'.

- Navigate to AREA B to determine the base amount for line 015. Enter the base amount or allocated base amount as specified.

- Fill in any additional associated corporation details required in AREA A and calculate allocation amounts based on the percentage as outlined.

- Once completed, save the changes made to the form, and if desired, download, print, or share it as necessary.

Complete your documents online now to ensure accuracy and efficiency!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To obtain your notice of assessment in Alberta, you typically need to file your tax returns using the Alberta AT1 Schedule 1. Once processed, the Alberta government sends your notice directly to you. If you need additional support with the filing process, the uslegalforms platform can simplify the steps and ensure you receive all necessary assessments on time.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.