Loading

Get Usda Rd 4279-5 2005

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the USDA RD 4279-5 online

Filling out the USDA RD 4279-5 form can seem daunting, but with the right guidance, you can complete it efficiently and accurately. This guide offers a detailed explanation of each section of the form, ensuring a smooth online filling process.

Follow the steps to complete the USDA RD 4279-5 form online.

- Click the ‘Get Form’ button to obtain the form and open it in your editor.

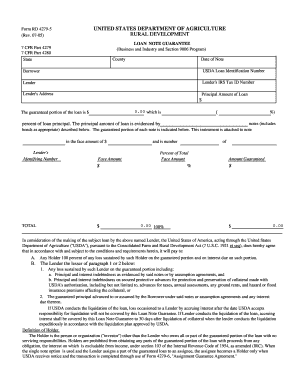

- Begin by entering the date of the note in the designated field.

- Specify the county where the loan is applicable.

- Indicate the state related to the transaction.

- Fill in the borrower's information, including their name and address.

- Enter the USDA loan identification number to identify your loan.

- Complete the lender's information, including their name, IRS tax ID number, and address.

- Specify the principal amount of the loan in the required field.

- Detail the guaranteed portion of the loan, expressed as a percentage of the loan principal.

- Indicate the face amount of the notes associated with the loan, if applicable, and provide any identifying numbers for each note.

- Confirm all details are correct before submitting.

- After completing the form, save your changes, and choose to download, print, or share the completed USDA RD 4279-5 form.

Start filling out your USDA RD 4279-5 form online today to secure your loan guarantee.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

The process for USDA approval typically starts with an application, where you provide detailed financial information to demonstrate your eligibility. After submission, the lender reviews the application and can request additional documentation. Following this, USDA RD 4279-5 outlines the steps for formal approval, ensuring a transparent pathway to funding.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.