Loading

Get Da 5472-r 2005-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the DA 5472-R online

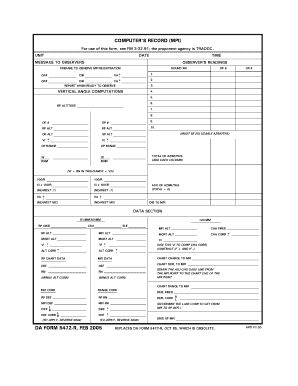

The DA 5472-R form is essential for recording and managing military operations. This guide aims to provide clear instructions for users on how to accurately complete the form online, ensuring your data is organized and compliant.

Follow the steps to complete the DA 5472-R form online.

- Click 'Get Form' button to obtain the form and access it in your preferred editor.

- Begin by filling in the unit details. Clearly provide your unit designation in the designated section at the top of the form.

- Next, indicate the date and time in the specified fields. Ensure the format is clear and standardized to avoid confusion.

- Move to the message to observers section - compose a concise message that clearly communicates critical instructions to observers.

- Enter the observer’s readings in the appropriate section, making sure to follow any specific instructions regarding the format and units of measurement.

- For the round number and operational numbers, input the relevant data, ensuring consistency and accuracy across all entries.

- Continue with the vertical angle computations and input all relevant metrics. Pay careful attention to rounding as specified in the guidance.

- Once all fields have been completed, review the entire form for any errors. Then save your changes, download, or print the document as needed.

Complete your DA 5472-R form online today to ensure efficient digital document management.

To fill out the employee's withholding allowance certificate in California, start with personal details and select your appropriate filing status. The number of allowances should reflect your dependents and other relevant financial aspects. Using platforms like USLegalForms can help simplify this procedure while ensuring compliance with necessary forms, including DA 5472-R.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.