Get Wf 10576 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the WF 10576 online

The WF 10576 is a crucial document required for new practitioner enrollment with Blue Cross Blue Shield of Michigan and Blue Care Network. This guide provides a clear, step-by-step process for completing the form online, ensuring you can submit your application accurately and efficiently.

Follow the steps to successfully complete the WF 10576 online.

- Press the ‘Get Form’ button to access the WF 10576 form in the online editor.

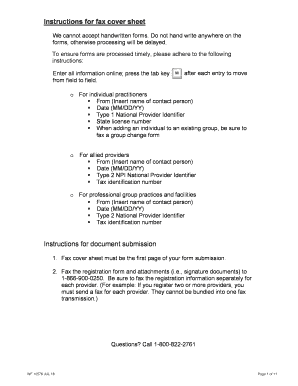

- Fill in the 'From' section with the name of the contact person and the 'Date' in MM/DD/YY format.

- Enter your Type 1 National Provider Identifier and State license number in the designated fields.

- For individual practitioners, complete the required fields ensuring to fax a group change form if applicable.

- If you are an allied provider, input your Type 2 National Provider Identifier and Tax identification number where requested.

- For professional group practices and facilities, ensure to include the same identifying information as above.

- Proceed through each section, filling out demographic, EIN/tax information, specialty, address data, services, and any additional locations as required.

- Review sections for accuracy, especially the Application signature section where you confirm the truthfulness of your entries.

- Once all sections are complete, save your changes, then choose to download, print, or share the completed form as necessary.

Get started with your online submission of the WF 10576 today!

Get form

Filing Form 4684 involves several steps. First, gather all necessary documentation regarding your property and losses. Next, complete the form accurately, making sure to include all relevant details surrounding your loss. Once completed, attach it to your federal tax return. If you require assistance, the US Legal Forms platform is available to help you navigate through the filing process, ensuring you have the right resources at your fingertips.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.