Get Fannie Mae/freddie Mac 3131 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign Fannie Mae/Freddie Mac 3131 online

How to fill out and sign Fannie Mae/Freddie Mac 3131 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Experience all the advantages of preparing and filing legal documents online. With our platform, submitting Fannie Mae/Freddie Mac 3131 takes only a few moments. We facilitate this by providing access to our comprehensive editor effective for altering/correcting a document's initial wording, adding special fields, and electronic signing.

Complete Fannie Mae/Freddie Mac 3131 in merely a few minutes by following the steps below:

Transmit your Fannie Mae/Freddie Mac 3131 in an electronic format once you finish filling it out. Your data is securely protected, as we adhere to the most current security standards. Join millions of satisfied customers who are already submitting legal forms directly from their homes.

- Choose the document template you require from the collection of legal forms.

- Click on the Get form button to open it and begin editing.

- Fill out the required fields (they will be highlighted in yellow).

- The Signature Wizard will assist you in adding your digital signature right after you have finished entering the information.

- Insert the necessary date.

- Review the entire document to ensure all information is complete and no changes are needed.

- Press Done and download the completed form to your device.

How to modify Get Fannie Mae/Freddie Mac 3131 2016: personalize forms online

Your easily adjustable and customizable Get Fannie Mae/Freddie Mac 3131 2016 template is readily accessible. Make the most of our collection with a built-in online editor.

Do you delay finishing Get Fannie Mae/Freddie Mac 3131 2016 because you simply don't know where to begin and how to proceed? We comprehend your feelings and have an excellent solution for you that is unrelated to battling your procrastination!

Our online repository of pre-prepared templates lets you search through and select from thousands of editable forms suited for a variety of applications and situations. But acquiring the file is just the beginning. We provide you with all the essential tools to fill out, sign, and modify the template of your selection without leaving our site.

All you need to do is to access the template in the editor. Review the language of Get Fannie Mae/Freddie Mac 3131 2016 and confirm whether it aligns with what you’re looking for. Begin completing the form by utilizing the annotation features to give your form a more structured and tidy appearance.

Once you’re finished with the template, you can download the document in any available format or choose from various sharing or delivery options.

Using our professional tool, your finalized documents will always be officially binding and completely encrypted. We ensure the protection of your most sensitive information.

Acquire what is necessary to create a professional-grade Get Fannie Mae/Freddie Mac 3131 2016. Make a wise decision and try our platform today!

- Insert checkmarks, circles, arrows, and lines.

- Highlight, blackout, and adjust the existing text.

- If the template is intended for additional users, you can include fillable fields and share them for others to complete.

- A comprehensive suite of editing and annotation capabilities.

- An integrated legally-binding eSignature mechanism.

- The capacity to create documents from scratch or based on the pre-drafted template.

- Compatibility with various platforms and devices for enhanced convenience.

- Numerous options for securing your files.

- A range of delivery methods for more seamless sharing and sending out documents.

- Adherence to eSignature regulations governing the employment of eSignatures in online dealings.

Get form

Related links form

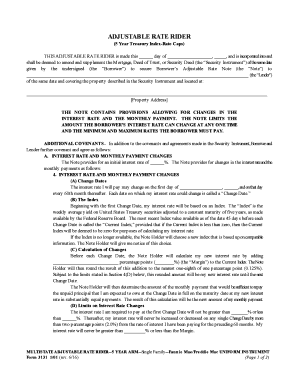

To determine if your mortgage is backed by Fannie Mae or Freddie Mac, start by checking your mortgage statements or documents. Look for their logos or mention of either agency in your paperwork. You can also visit the official websites of Fannie Mae and Freddie Mac to use their lookup tools. Understanding whether your mortgage falls under Fannie Mae/Freddie Mac 3131 guidelines can help you make informed financial decisions.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.