Get Aflac Substitute W-9 2013-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Aflac Substitute W-9 online

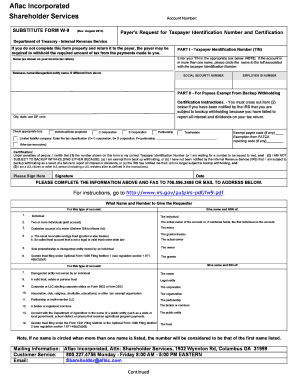

Completing the Aflac Substitute W-9 form online is a straightforward process that allows you to provide your taxpayer identification information to Aflac. This guide will walk you through each section of the form to ensure that it is filled out accurately and submitted without issues.

Follow the steps to complete your Aflac Substitute W-9 online.

- Press the ‘Get Form’ button to obtain the Aflac Substitute W-9 form and open it in the digital editor.

- In Part I, enter your Taxpayer Identification Number (TIN) in the designated box. If the account is associated with more than one individual, be sure to circle the name linked to the TIN provided.

- Provide your full name as it appears on your income tax return. If there is a business name or disregarded entity name that differs from your name, include that as well.

- Select the appropriate type of taxpayer by checking the correct box in Part II. Options include individual/sole proprietor, C corporation, S corporation, partnership, trust/estate, or limited liability company. If you select the limited liability company option, specify the tax classification.

- If applicable, fill in the exemption codes in the designated fields. Review the list of exempt payee codes and FATCA exemption codes if you believe you qualify.

- Complete the certification statement at the bottom of the form. Ensure you acknowledge and certify that the TIN is correct, and that you are not subject to backup withholding unless you meet the specified conditions.

- Sign and date the form in the 'Please Sign Here' section to validate your certification.

- Once fully completed, you can save your changes, download the form for your records, or share it as necessary. Make sure to follow any further submission instructions, such as faxes or mail addresses provided.

Complete your Aflac Substitute W-9 online today for efficient document management.

Related links form

The substitute for a W-9 is a form that allows payees to provide their taxpayer information for reporting purposes. The Aflac Substitute W-9 serves as a document that you can use in lieu of the standard W-9 form when required. This form still requires you to fill in your tax identification details to ensure compliance. Having the correct forms is essential for both businesses and individuals, so consider exploring options available on platforms like UsLegalForms.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.