Loading

Get Aba Retirement Funds Form 2 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the ABA Retirement Funds Form 2 online

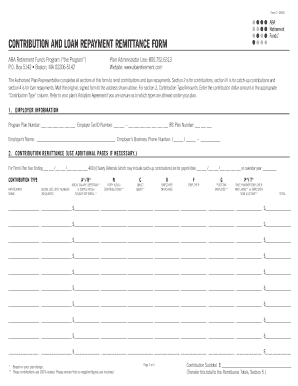

Filling out the ABA Retirement Funds Form 2 online is an essential step for authorized representatives to remit contributions and loan repayments accurately. This guide provides detailed, step-by-step instructions to assist you in completing the form correctly.

Follow the steps to successfully complete the form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the employer information in section 1. Fill in the Program Plan Number, Employer Tax ID Number, IRS Plan Number, Employer’s Name, and Employer’s Business Phone Number.

- In section 2, Contribution Remittance, specify the firm’s plan year ending date. Enter the contribution dollar amounts in the appropriate 'Contribution Type' columns, ensuring you reference the plan’s Adoption Agreement for allowed types.

- If applicable, use section 3 for Catch-Up Contributions for individuals age 50 and over. Ensure all fields are completed and specify the catch-up amounts for the respective contributions.

- For loan repayments, complete section 4 with the participant name, social security number, loan number, and repayment amounts.

- In section 5, calculate the totals for contributions, catch-up contributions, and loan repayments. Input these amounts to arrive at the grand total.

- In section 6, provide deposit information and ensure all checks attached are properly listed. Verify numbers match the grand total from section 5.

- Finally, in section 7, have the authorized plan representative sign and date the form.

- After completing the form, save the changes. You can then download, print, or share the form as needed.

Complete your documents online today for a seamless experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To withdraw from your retirement annuity, you must first review the specific terms set by ABA Retirement Funds. Generally, you will need to complete a withdrawal form, which can often be found on their website. Once submitted, the processing time will depend on their policies, so please plan accordingly to ensure you meet your financial needs.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.