Loading

Get Tn Bsd-cs-2122 2016-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TN BSD-CS-2122 online

This guide provides a clear and user-friendly approach to completing the TN BSD-CS-2122 form online. Users will find step-by-step instructions to ensure that all necessary information is accurately submitted.

Follow the steps to successfully complete the form:

- Click ‘Get Form’ button to retrieve the TN BSD-CS-2122 and access it in your preferred online format.

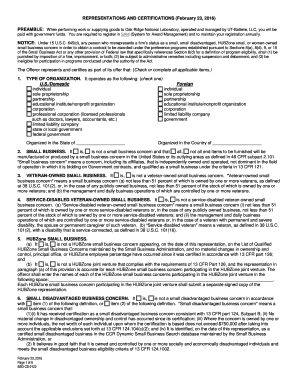

- Begin by indicating the type of organization you operate as. Select the appropriate checkbox to describe your entity—either U.S./Domestic or Foreign—and fill in the corresponding state or country of organization.

- Determine your small business status. Indicate whether you are or are not a small business concern by selecting the appropriate checkbox.

- Identify if your business is a veteran-owned small business. Check the correct box to signify this status.

- Complete the next section regarding service-disabled veteran-owned small businesses, marking whether this applies to your organization.

- If applicable, indicate your HUBZone small business status. Ensure to fill out additional fields if you are part of a HUBZone joint venture.

- Indicate if your business qualifies as a small disadvantaged business by selecting the appropriate checkbox.

- Confirm if your business is a women-owned small business by choosing the corresponding option.

- Affirm that you have not participated in any unlawful kickbacks relating to the offer.

- Provide details regarding the Buy American compliance if applicable, particularly if your offer exceeds $3,000.

- If your offer exceeds $25,000, input the names and total compensation of your highest-paid executives as required.

- Check the appropriate box regarding employment eligibility verification as appointed if the offer exceeds $3,000.

- Confirm compliance with equal opportunity requirements as needed if the offer exceeds $10,000.

- Indicate your compliance with affirmative action policies if the offer exceeds $10,000.

- Certify your responsibility matters if your offer exceeds $30,000 by selecting the necessary certifications.

- Complete the relevant sections regarding payments to influence federal transactions if applicable.

- Certify compliance with toxic chemical release reporting if your offer exceeds $100,000.

- Affirm compliance with veterans' employment reporting requirements if your offer exceeds $150,000.

- Provide your annual revenue and average number of employees if certifying as a small business, ensuring all data is accurate.

- Confirm if you are registered and if your SAM (System for Award Management) registration is active.

- Once all sections are filled correctly, review your entries for accuracy before you proceed to save changes, download, or print the form.

Complete your TN BSD-CS-2122 form online today for a smooth submission process.

If you earn income in Tennessee, you are typically required to file a state tax return. This includes income earned through employment or business, necessitating the filing of a TN BSD-CS-2122. Filing accurately ensures your compliance and minimizes the risk of penalties. Navigating this process is simpler with the support of resources available through the US Legal Forms platform.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.