Loading

Get In 53788 2009-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IN 53788 online

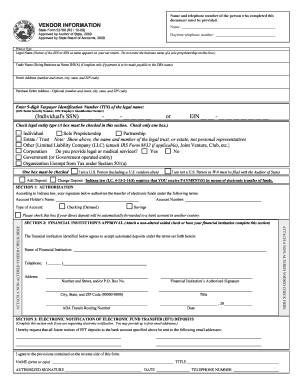

Filling out the IN 53788 form online is a necessary process for providing accurate vendor information to the State of Indiana. This user-friendly guide will walk you through each section and field of the form, ensuring you complete it correctly and efficiently.

Follow the steps to fill out the IN 53788 form effectively.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- Provide the name and telephone number of the person completing the document in the designated fields.

- In the vendor information section, enter the legal name as it appears on your tax return. If applicable, provide the trade name in the relevant field; complete this only if the payment is to be made to a business name.

- Fill in the remit address with the complete mailing address, including number and street, city, state, and ZIP code.

- Complete the purchase order address section if you have a different address for purchase orders.

- Enter the 9-digit Taxpayer Identification Number (TIN) of the legal name, ensuring that you select the correct format for either an individual’s Social Security Number (SSN) or an Employer Identification Number (EIN).

- Select the appropriate legal entity type by checking one box in the corresponding section.

- In the authorization section, provide the account holder’s name, account number, and type of account. If applicable, indicate if the direct deposit will be forwarded to a bank account in another country.

- Complete Section 2 by having your financial institution approve the information, or attach a non-altered voided check.

- If you wish to receive electronic notifications of EFT deposits, complete Section 3 with email addresses for notification.

- Review all provided information for accuracy, sign the form, and securely retain a copy for your records.

- Submit the completed form by faxing it to (317) 234-1916 or mailing it to the Indiana Auditor of State at the designated address.

Start filling out your IN 53788 form online to ensure accurate vendor information.

Filing Form 26Q on the income tax portal requires you to log into your account and navigate to the TDS filing section. Make sure you have all required details handy, as accuracy is essential. Fill out the form completely and review it before submission. With tools from uslegalforms, you can simplify your filing process and ensure compliance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.