Loading

Get Ca Cdtfa-269-a (formerly Boe-269-a) 2018-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA CDTFA-269-A (Formerly BOE-269-A) online

This guide is designed to assist users in completing the CA CDTFA-269-A form online, ensuring accuracy and compliance with state regulations. Follow these clear instructions to navigate the form effectively and fulfill your reporting requirements.

Follow the steps to complete the CA CDTFA-269-A form online with ease.

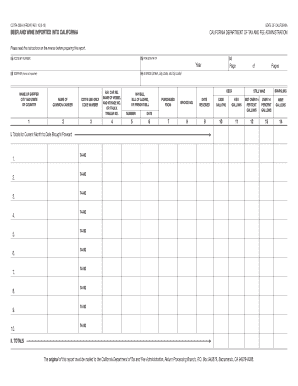

- Press the ‘Get Form’ button to access the CA CDTFA-269-A form and open it for editing.

- In section (a), input your account number associated with your beer and wine importer registration.

- For section (b), specify the month for which you are reporting.

- In section (c), enter the year of the report.

- Insert your business name in section (d), indicating the taxpayer's name.

- In section (e), provide your complete address including street, city, state, and zip code.

- For each subsequent page, start with row I by entering totals for columns 10 through 14 from the previous page.

- In column 1, detail the name of the shipper, along with the city and state, or country of origin.

- Column 2 requires you to enter the name of the carrier responsible for transporting the shipment.

- Column 4 is designated for entering the rail car number, vessel name and voyage number, or truck trailer number used for transport.

- Provide the waybill, bill of lading, or freight bill number in column 5.

- In column 6, enter the date referenced on the waybill, bill of lading, or freight bill.

- Column 7 requires the name of the seller from whom the beer or wine was purchased.

- Input the invoice number related to the shipment in column 8.

- In column 9, specify the date when the beer or wine was received.

- For column 10, calculate the total gallons of case beer by dividing the total ounces by 128 and rounding to the nearest gallon.

- In column 11, determine the total gallons of keg beer by multiplying the barrels by 31 and rounding accordingly.

- Column 12 is for entering total gallons of wine not exceeding 14 percent alcohol.

- In column 13, note total gallons of wine exceeding 14 percent alcohol.

- Column 14 should contain total gallons of sparkling wine, ensuring to convert liters to gallons as needed.

- To conclude, sum totals for columns 10 through 14 in row II and carry these forward to the next page, if applicable.

- Upon completion, save your changes, then download, print, or share the form as necessary.

Complete your CA CDTFA-269-A form online for accurate and timely compliance with reporting obligations.

Anyone engaged in business activities that require sales tax collection must register with the CA CDTFA. This primarily includes retailers, service providers, and certain non-profits that make taxable sales. By registering, you ensure compliance with state laws and can access necessary resources like the CA CDTFA-269-A (Formerly BOE-269-A) form for your needs.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.