Loading

Get Ky Form Qcc1 2015-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the KY Form QCC1 online

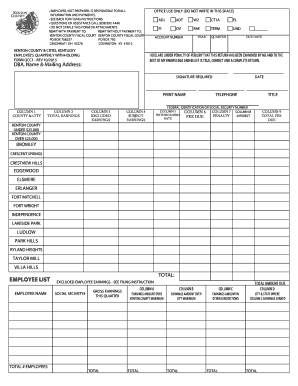

Filing the KY Form QCC1 online is an essential process for employers in Kenton County to report employee withholding accurately. This guide provides a step-by-step approach to completing the form effectively, ensuring that all necessary information is captured correctly.

Follow the steps to complete your KY Form QCC1 online

- Use the ‘Get Form’ button to obtain the KY Form QCC1 and open it in your preferred document editor.

- Begin by entering your account number at the top of the form. This number is crucial for processing your filing.

- Fill in the year you are reporting and specify the term relevant to the quarter for which you are filing.

- Indicate the due date for this submission to ensure timely processing.

- Complete the DBA, name, and mailing address section with accurate information pertaining to your business.

- In the columns provided, enter the relevant details for each employee, such as total earnings, excluded earnings, subject earnings, withholding rates, penalties, interest, and total fees due.

- Define your employee list by providing names, Social Security numbers, gross earnings for the quarter, and any other required data.

- Review all entered information for accuracy to prevent errors that might lead to penalties or delays.

- Once you have filled out the form completely and reviewed your entries, save your changes, and choose to download, print, or share the form as required.

Complete your KY Form QCC1 online for timely and efficient filing.

Your Kentucky withholding number is typically listed on your W-2 form or can be obtained from your employer. If you cannot find it, reach out to your HR or payroll department for help. Having this number at hand is crucial for accurate completion of forms like the KY Form QCC1.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.