Loading

Get Ca De 926c 2015-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA DE 926C online

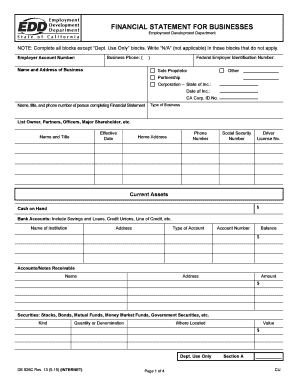

The CA DE 926C form is essential for businesses to provide a detailed financial statement to the Employment Development Department. This guide offers clear instructions on how to fill out the form online, ensuring that all necessary information is accurately reported.

Follow the steps to complete the CA DE 926C form online

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your employer account number in the designated field. This number is crucial for identifying your business with the Employment Development Department.

- Provide your business phone number in the format specified, ensuring it is accurate for any necessary follow-ups or verification.

- Fill in the name and address of the business. Make sure this information matches what is on file with the state.

- Enter the federal employer identification number (EIN) if applicable. If your business is a sole proprietorship, mark that option, or choose another relevant designation.

- Indicate the type of business, selecting from options such as sole proprietor, partnership, or corporation. If a corporation, provide the state of incorporation and the corporate identification number.

- List the name, title, and contact number of the individual completing the financial statement for clarity.

- In the current assets section, itemize all cash on hand and bank accounts, including names of institutions, balances, and account details.

- Document your accounts/notes receivable, detailing names, addresses, and outstanding amounts.

- Record securities owned, including stocks and bonds, providing the necessary details on quantity and current value.

- Complete the current liabilities section by listing all accounts/taxes payable including names, addresses, and outstanding balances.

- Identify available credit sources like bank charge cards and savings accounts, including amounts owed and minimum monthly payments.

- Supply information on business assets such as machinery or vehicles, noting their descriptions and equity.

- Add real property assets with ownership details, physical addresses, and descriptions of the property’s use.

- Provide details for monthly income, ensuring all sources including sales and dividends are accurately reported.

- List necessary monthly operating expenses and document any other monthly expenses that apply to your business.

- Complete the general financial information section, marking any necessary declarations and providing explanations where required.

- Before submitting, review the entire form for completeness. Save changes, then download, print, or share as necessary.

Complete your CA DE 926C form online today for a streamlined financial reporting process.

To obtain a copy of your California state tax return, visit the California Franchise Tax Board's website. You can request a copy online or through the mail. Make sure you provide necessary identifiers and details, including references to forms like the CA DE 926C, to ensure a smooth retrieval process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.